Compare commits

No commits in common. "develop" and "2022.2.2" have entirely different histories.

|

|

@ -11,14 +11,12 @@

|

|||

"mounts": [

|

||||

"source=freqtrade-bashhistory,target=/home/ftuser/commandhistory,type=volume"

|

||||

],

|

||||

"workspaceMount": "source=${localWorkspaceFolder},target=/workspaces/freqtrade,type=bind,consistency=cached",

|

||||

// Uncomment to connect as a non-root user if you've added one. See https://aka.ms/vscode-remote/containers/non-root.

|

||||

"remoteUser": "ftuser",

|

||||

|

||||

"onCreateCommand": "pip install --user -e .",

|

||||

"postCreateCommand": "freqtrade create-userdir --userdir user_data/",

|

||||

|

||||

"workspaceFolder": "/workspaces/freqtrade",

|

||||

"workspaceFolder": "/freqtrade/",

|

||||

|

||||

"settings": {

|

||||

"terminal.integrated.shell.linux": "/bin/bash",

|

||||

|

|

|

|||

|

|

@ -20,7 +20,7 @@ Please do not use bug reports to request new features.

|

|||

* Operating system: ____

|

||||

* Python Version: _____ (`python -V`)

|

||||

* CCXT version: _____ (`pip freeze | grep ccxt`)

|

||||

* Freqtrade Version: ____ (`freqtrade -V` or `docker compose run --rm freqtrade -V` for Freqtrade running in docker)

|

||||

* Freqtrade Version: ____ (`freqtrade -V` or `docker-compose run --rm freqtrade -V` for Freqtrade running in docker)

|

||||

|

||||

Note: All issues other than enhancement requests will be closed without further comment if the above template is deleted or not filled out.

|

||||

|

||||

|

|

|

|||

|

|

@ -18,9 +18,10 @@ Have you search for this feature before requesting it? It's highly likely that a

|

|||

* Operating system: ____

|

||||

* Python Version: _____ (`python -V`)

|

||||

* CCXT version: _____ (`pip freeze | grep ccxt`)

|

||||

* Freqtrade Version: ____ (`freqtrade -V` or `docker compose run --rm freqtrade -V` for Freqtrade running in docker)

|

||||

* Freqtrade Version: ____ (`freqtrade -V` or `docker-compose run --rm freqtrade -V` for Freqtrade running in docker)

|

||||

|

||||

|

||||

## Describe the enhancement

|

||||

|

||||

*Explain the enhancement you would like*

|

||||

|

||||

|

|

|

|||

|

|

@ -18,7 +18,7 @@ Please do not use the question template to report bugs or to request new feature

|

|||

* Operating system: ____

|

||||

* Python Version: _____ (`python -V`)

|

||||

* CCXT version: _____ (`pip freeze | grep ccxt`)

|

||||

* Freqtrade Version: ____ (`freqtrade -V` or `docker compose run --rm freqtrade -V` for Freqtrade running in docker)

|

||||

* Freqtrade Version: ____ (`freqtrade -V` or `docker-compose run --rm freqtrade -V` for Freqtrade running in docker)

|

||||

|

||||

## Your question

|

||||

|

||||

|

|

|

|||

|

|

@ -1,9 +1,9 @@

|

|||

<!-- Thank you for sending your pull request. But first, have you included

|

||||

Thank you for sending your pull request. But first, have you included

|

||||

unit tests, and is your code PEP8 conformant? [More details](https://github.com/freqtrade/freqtrade/blob/develop/CONTRIBUTING.md)

|

||||

-->

|

||||

|

||||

## Summary

|

||||

|

||||

<!-- Explain in one sentence the goal of this PR -->

|

||||

Explain in one sentence the goal of this PR

|

||||

|

||||

Solve the issue: #___

|

||||

|

||||

|

|

@ -14,4 +14,4 @@ Solve the issue: #___

|

|||

|

||||

## What's new?

|

||||

|

||||

<!-- Explain in details what this PR solve or improve. You can include visuals. -->

|

||||

*Explain in details what this PR solve or improve. You can include visuals.*

|

||||

|

|

|

|||

|

|

@ -13,37 +13,32 @@ on:

|

|||

schedule:

|

||||

- cron: '0 5 * * 4'

|

||||

|

||||

concurrency:

|

||||

group: ${{ github.workflow }}-${{ github.ref }}

|

||||

cancel-in-progress: true

|

||||

permissions:

|

||||

repository-projects: read

|

||||

jobs:

|

||||

build_linux:

|

||||

|

||||

runs-on: ${{ matrix.os }}

|

||||

strategy:

|

||||

matrix:

|

||||

os: [ ubuntu-20.04, ubuntu-22.04 ]

|

||||

python-version: ["3.8", "3.9", "3.10", "3.11"]

|

||||

os: [ ubuntu-18.04, ubuntu-20.04 ]

|

||||

python-version: ["3.8", "3.9", "3.10"]

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

- uses: actions/checkout@v2

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

uses: actions/setup-python@v2

|

||||

with:

|

||||

python-version: ${{ matrix.python-version }}

|

||||

|

||||

- name: Cache_dependencies

|

||||

uses: actions/cache@v3

|

||||

uses: actions/cache@v2

|

||||

id: cache

|

||||

with:

|

||||

path: ~/dependencies/

|

||||

key: ${{ runner.os }}-dependencies

|

||||

|

||||

- name: pip cache (linux)

|

||||

uses: actions/cache@v3

|

||||

uses: actions/cache@v2

|

||||

if: runner.os == 'Linux'

|

||||

with:

|

||||

path: ~/.cache/pip

|

||||

|

|

@ -67,9 +62,15 @@ jobs:

|

|||

- name: Tests

|

||||

run: |

|

||||

pytest --random-order --cov=freqtrade --cov-config=.coveragerc

|

||||

if: matrix.python-version != '3.9'

|

||||

|

||||

- name: Tests incl. ccxt compatibility tests

|

||||

run: |

|

||||

pytest --random-order --cov=freqtrade --cov-config=.coveragerc --longrun

|

||||

if: matrix.python-version == '3.9'

|

||||

|

||||

- name: Coveralls

|

||||

if: (runner.os == 'Linux' && matrix.python-version == '3.10' && matrix.os == 'ubuntu-22.04')

|

||||

if: (runner.os == 'Linux' && matrix.python-version == '3.8')

|

||||

env:

|

||||

# Coveralls token. Not used as secret due to github not providing secrets to forked repositories

|

||||

COVERALLS_REPO_TOKEN: 6D1m0xupS3FgutfuGao8keFf9Hc0FpIXu

|

||||

|

|

@ -77,31 +78,29 @@ jobs:

|

|||

# Allow failure for coveralls

|

||||

coveralls || true

|

||||

|

||||

- name: Backtesting (multi)

|

||||

- name: Backtesting

|

||||

run: |

|

||||

cp config_examples/config_bittrex.example.json config.json

|

||||

freqtrade create-userdir --userdir user_data

|

||||

freqtrade new-strategy -s AwesomeStrategy

|

||||

freqtrade new-strategy -s AwesomeStrategyMin --template minimal

|

||||

freqtrade backtesting --datadir tests/testdata --strategy-list AwesomeStrategy AwesomeStrategyMin -i 5m

|

||||

freqtrade backtesting --datadir tests/testdata --strategy SampleStrategy

|

||||

|

||||

- name: Hyperopt

|

||||

run: |

|

||||

cp config_examples/config_bittrex.example.json config.json

|

||||

freqtrade create-userdir --userdir user_data

|

||||

freqtrade hyperopt --datadir tests/testdata -e 6 --strategy SampleStrategy --hyperopt-loss SharpeHyperOptLossDaily --print-all

|

||||

freqtrade hyperopt --datadir tests/testdata -e 5 --strategy SampleStrategy --hyperopt-loss SharpeHyperOptLossDaily --print-all

|

||||

|

||||

- name: Flake8

|

||||

run: |

|

||||

flake8

|

||||

|

||||

- name: Sort imports (isort)

|

||||

run: |

|

||||

isort --check .

|

||||

|

||||

- name: Run Ruff

|

||||

run: |

|

||||

ruff check --format=github .

|

||||

|

||||

- name: Mypy

|

||||

run: |

|

||||

mypy freqtrade scripts tests

|

||||

mypy freqtrade scripts

|

||||

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

|

|

@ -116,25 +115,25 @@ jobs:

|

|||

strategy:

|

||||

matrix:

|

||||

os: [ macos-latest ]

|

||||

python-version: ["3.8", "3.9", "3.10", "3.11"]

|

||||

python-version: ["3.8", "3.9", "3.10"]

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

- uses: actions/checkout@v2

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

uses: actions/setup-python@v2

|

||||

with:

|

||||

python-version: ${{ matrix.python-version }}

|

||||

|

||||

- name: Cache_dependencies

|

||||

uses: actions/cache@v3

|

||||

uses: actions/cache@v2

|

||||

id: cache

|

||||

with:

|

||||

path: ~/dependencies/

|

||||

key: ${{ runner.os }}-dependencies

|

||||

|

||||

- name: pip cache (macOS)

|

||||

uses: actions/cache@v3

|

||||

uses: actions/cache@v2

|

||||

if: runner.os == 'macOS'

|

||||

with:

|

||||

path: ~/Library/Caches/pip

|

||||

|

|

@ -149,19 +148,6 @@ jobs:

|

|||

if: runner.os == 'macOS'

|

||||

run: |

|

||||

brew update

|

||||

# homebrew fails to update python due to unlinking failures

|

||||

# https://github.com/actions/runner-images/issues/6817

|

||||

rm /usr/local/bin/2to3 || true

|

||||

rm /usr/local/bin/2to3-3.11 || true

|

||||

rm /usr/local/bin/idle3 || true

|

||||

rm /usr/local/bin/idle3.11 || true

|

||||

rm /usr/local/bin/pydoc3 || true

|

||||

rm /usr/local/bin/pydoc3.11 || true

|

||||

rm /usr/local/bin/python3 || true

|

||||

rm /usr/local/bin/python3.11 || true

|

||||

rm /usr/local/bin/python3-config || true

|

||||

rm /usr/local/bin/python3.11-config || true

|

||||

|

||||

brew install hdf5 c-blosc

|

||||

python -m pip install --upgrade pip wheel

|

||||

export LD_LIBRARY_PATH=${HOME}/dependencies/lib:$LD_LIBRARY_PATH

|

||||

|

|

@ -172,14 +158,22 @@ jobs:

|

|||

|

||||

- name: Tests

|

||||

run: |

|

||||

pytest --random-order

|

||||

pytest --random-order --cov=freqtrade --cov-config=.coveragerc

|

||||

|

||||

- name: Coveralls

|

||||

if: (runner.os == 'Linux' && matrix.python-version == '3.8')

|

||||

env:

|

||||

# Coveralls token. Not used as secret due to github not providing secrets to forked repositories

|

||||

COVERALLS_REPO_TOKEN: 6D1m0xupS3FgutfuGao8keFf9Hc0FpIXu

|

||||

run: |

|

||||

# Allow failure for coveralls

|

||||

coveralls -v || true

|

||||

|

||||

- name: Backtesting

|

||||

run: |

|

||||

cp config_examples/config_bittrex.example.json config.json

|

||||

freqtrade create-userdir --userdir user_data

|

||||

freqtrade new-strategy -s AwesomeStrategyAdv --template advanced

|

||||

freqtrade backtesting --datadir tests/testdata --strategy AwesomeStrategyAdv

|

||||

freqtrade backtesting --datadir tests/testdata --strategy SampleStrategy

|

||||

|

||||

- name: Hyperopt

|

||||

run: |

|

||||

|

|

@ -187,14 +181,14 @@ jobs:

|

|||

freqtrade create-userdir --userdir user_data

|

||||

freqtrade hyperopt --datadir tests/testdata -e 5 --strategy SampleStrategy --hyperopt-loss SharpeHyperOptLossDaily --print-all

|

||||

|

||||

- name: Flake8

|

||||

run: |

|

||||

flake8

|

||||

|

||||

- name: Sort imports (isort)

|

||||

run: |

|

||||

isort --check .

|

||||

|

||||

- name: Run Ruff

|

||||

run: |

|

||||

ruff check --format=github .

|

||||

|

||||

- name: Mypy

|

||||

run: |

|

||||

mypy freqtrade scripts

|

||||

|

|

@ -213,18 +207,18 @@ jobs:

|

|||

strategy:

|

||||

matrix:

|

||||

os: [ windows-latest ]

|

||||

python-version: ["3.8", "3.9", "3.10", "3.11"]

|

||||

python-version: ["3.8", "3.9", "3.10"]

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

- uses: actions/checkout@v2

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

uses: actions/setup-python@v2

|

||||

with:

|

||||

python-version: ${{ matrix.python-version }}

|

||||

|

||||

- name: Pip cache (Windows)

|

||||

uses: actions/cache@v3

|

||||

uses: actions/cache@preview

|

||||

with:

|

||||

path: ~\AppData\Local\pip\Cache

|

||||

key: ${{ matrix.os }}-${{ matrix.python-version }}-pip

|

||||

|

|

@ -235,7 +229,7 @@ jobs:

|

|||

|

||||

- name: Tests

|

||||

run: |

|

||||

pytest --random-order

|

||||

pytest --random-order --cov=freqtrade --cov-config=.coveragerc

|

||||

|

||||

- name: Backtesting

|

||||

run: |

|

||||

|

|

@ -249,13 +243,13 @@ jobs:

|

|||

freqtrade create-userdir --userdir user_data

|

||||

freqtrade hyperopt --datadir tests/testdata -e 5 --strategy SampleStrategy --hyperopt-loss SharpeHyperOptLossDaily --print-all

|

||||

|

||||

- name: Run Ruff

|

||||

- name: Flake8

|

||||

run: |

|

||||

ruff check --format=github .

|

||||

flake8

|

||||

|

||||

- name: Mypy

|

||||

run: |

|

||||

mypy freqtrade scripts tests

|

||||

mypy freqtrade scripts

|

||||

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

|

|

@ -265,44 +259,19 @@ jobs:

|

|||

details: Test Failed

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

|

||||

mypy_version_check:

|

||||

runs-on: ubuntu-22.04

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

with:

|

||||

python-version: "3.10"

|

||||

|

||||

- name: pre-commit dependencies

|

||||

run: |

|

||||

pip install pyaml

|

||||

python build_helpers/pre_commit_update.py

|

||||

|

||||

pre-commit:

|

||||

runs-on: ubuntu-22.04

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- uses: actions/setup-python@v4

|

||||

with:

|

||||

python-version: "3.10"

|

||||

- uses: pre-commit/action@v3.0.0

|

||||

|

||||

docs_check:

|

||||

runs-on: ubuntu-22.04

|

||||

runs-on: ubuntu-20.04

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

- uses: actions/checkout@v2

|

||||

|

||||

- name: Documentation syntax

|

||||

run: |

|

||||

./tests/test_docs.sh

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

uses: actions/setup-python@v2

|

||||

with:

|

||||

python-version: "3.10"

|

||||

python-version: 3.8

|

||||

|

||||

- name: Documentation build

|

||||

run: |

|

||||

|

|

@ -318,70 +287,19 @@ jobs:

|

|||

details: Freqtrade doc test failed!

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

|

||||

|

||||

build_linux_online:

|

||||

# Run pytest with "live" checks

|

||||

runs-on: ubuntu-22.04

|

||||

cleanup-prior-runs:

|

||||

runs-on: ubuntu-20.04

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

with:

|

||||

python-version: "3.9"

|

||||

|

||||

- name: Cache_dependencies

|

||||

uses: actions/cache@v3

|

||||

id: cache

|

||||

with:

|

||||

path: ~/dependencies/

|

||||

key: ${{ runner.os }}-dependencies

|

||||

|

||||

- name: pip cache (linux)

|

||||

uses: actions/cache@v3

|

||||

if: runner.os == 'Linux'

|

||||

with:

|

||||

path: ~/.cache/pip

|

||||

key: test-${{ matrix.os }}-${{ matrix.python-version }}-pip

|

||||

|

||||

- name: TA binary *nix

|

||||

if: steps.cache.outputs.cache-hit != 'true'

|

||||

run: |

|

||||

cd build_helpers && ./install_ta-lib.sh ${HOME}/dependencies/; cd ..

|

||||

|

||||

- name: Installation - *nix

|

||||

if: runner.os == 'Linux'

|

||||

run: |

|

||||

python -m pip install --upgrade pip wheel

|

||||

export LD_LIBRARY_PATH=${HOME}/dependencies/lib:$LD_LIBRARY_PATH

|

||||

export TA_LIBRARY_PATH=${HOME}/dependencies/lib

|

||||

export TA_INCLUDE_PATH=${HOME}/dependencies/include

|

||||

pip install -r requirements-dev.txt

|

||||

pip install -e .

|

||||

|

||||

- name: Tests incl. ccxt compatibility tests

|

||||

- name: Cleanup previous runs on this branch

|

||||

uses: rokroskar/workflow-run-cleanup-action@v0.3.3

|

||||

if: "!startsWith(github.ref, 'refs/tags/') && github.ref != 'refs/heads/stable' && github.repository == 'freqtrade/freqtrade'"

|

||||

env:

|

||||

CI_WEB_PROXY: http://152.67.78.211:13128

|

||||

run: |

|

||||

pytest --random-order --cov=freqtrade --cov-config=.coveragerc --longrun

|

||||

|

||||

GITHUB_TOKEN: "${{ secrets.GITHUB_TOKEN }}"

|

||||

|

||||

# Notify only once - when CI completes (and after deploy) in case it's successfull

|

||||

notify-complete:

|

||||

needs: [

|

||||

build_linux,

|

||||

build_macos,

|

||||

build_windows,

|

||||

docs_check,

|

||||

mypy_version_check,

|

||||

pre-commit,

|

||||

build_linux_online

|

||||

]

|

||||

runs-on: ubuntu-22.04

|

||||

# Discord notification can't handle schedule events

|

||||

if: (github.event_name != 'schedule')

|

||||

permissions:

|

||||

repository-projects: read

|

||||

needs: [ build_linux, build_macos, build_windows, docs_check ]

|

||||

runs-on: ubuntu-20.04

|

||||

steps:

|

||||

|

||||

- name: Check user permission

|

||||

|

|

@ -401,18 +319,18 @@ jobs:

|

|||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

|

||||

deploy:

|

||||

needs: [ build_linux, build_macos, build_windows, docs_check, mypy_version_check, pre-commit ]

|

||||

runs-on: ubuntu-22.04

|

||||

needs: [ build_linux, build_macos, build_windows, docs_check ]

|

||||

runs-on: ubuntu-20.04

|

||||

|

||||

if: (github.event_name == 'push' || github.event_name == 'schedule' || github.event_name == 'release') && github.repository == 'freqtrade/freqtrade'

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

- uses: actions/checkout@v2

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

uses: actions/setup-python@v2

|

||||

with:

|

||||

python-version: "3.9"

|

||||

python-version: 3.8

|

||||

|

||||

- name: Extract branch name

|

||||

shell: bash

|

||||

|

|

@ -425,7 +343,7 @@ jobs:

|

|||

python setup.py sdist bdist_wheel

|

||||

|

||||

- name: Publish to PyPI (Test)

|

||||

uses: pypa/gh-action-pypi-publish@v1.8.5

|

||||

uses: pypa/gh-action-pypi-publish@master

|

||||

if: (github.event_name == 'release')

|

||||

with:

|

||||

user: __token__

|

||||

|

|

@ -433,7 +351,7 @@ jobs:

|

|||

repository_url: https://test.pypi.org/legacy/

|

||||

|

||||

- name: Publish to PyPI

|

||||

uses: pypa/gh-action-pypi-publish@v1.8.5

|

||||

uses: pypa/gh-action-pypi-publish@master

|

||||

if: (github.event_name == 'release')

|

||||

with:

|

||||

user: __token__

|

||||

|

|

@ -466,20 +384,28 @@ jobs:

|

|||

|

||||

- name: Build and test and push docker images

|

||||

env:

|

||||

IMAGE_NAME: freqtradeorg/freqtrade

|

||||

BRANCH_NAME: ${{ steps.extract_branch.outputs.branch }}

|

||||

run: |

|

||||

build_helpers/publish_docker_multi.sh

|

||||

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

if: always() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

severity: info

|

||||

details: Deploy Succeeded!

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

|

||||

|

||||

deploy_arm:

|

||||

permissions:

|

||||

packages: write

|

||||

needs: [ deploy ]

|

||||

# Only run on 64bit machines

|

||||

runs-on: [self-hosted, linux, ARM64]

|

||||

if: (github.event_name == 'push' || github.event_name == 'schedule' || github.event_name == 'release') && github.repository == 'freqtrade/freqtrade'

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

- uses: actions/checkout@v2

|

||||

|

||||

- name: Extract branch name

|

||||

shell: bash

|

||||

|

|

@ -495,16 +421,7 @@ jobs:

|

|||

|

||||

- name: Build and test and push docker images

|

||||

env:

|

||||

IMAGE_NAME: freqtradeorg/freqtrade

|

||||

BRANCH_NAME: ${{ steps.extract_branch.outputs.branch }}

|

||||

GHCR_USERNAME: ${{ github.actor }}

|

||||

GHCR_TOKEN: ${{ secrets.GITHUB_TOKEN }}

|

||||

run: |

|

||||

build_helpers/publish_docker_arm64.sh

|

||||

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

if: always() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false) && (github.event_name != 'schedule')

|

||||

with:

|

||||

severity: info

|

||||

details: Deploy Succeeded!

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

|

|

|

|||

|

|

@ -8,10 +8,11 @@ jobs:

|

|||

dockerHubDescription:

|

||||

runs-on: ubuntu-latest

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

- uses: actions/checkout@v1

|

||||

- name: Docker Hub Description

|

||||

uses: peter-evans/dockerhub-description@v3

|

||||

uses: peter-evans/dockerhub-description@v2.4.3

|

||||

env:

|

||||

DOCKERHUB_USERNAME: ${{ secrets.DOCKER_USERNAME }}

|

||||

DOCKERHUB_PASSWORD: ${{ secrets.DOCKER_PASSWORD }}

|

||||

DOCKERHUB_REPOSITORY: freqtradeorg/freqtrade

|

||||

|

||||

|

|

|

|||

|

|

@ -7,15 +7,10 @@ logfile.txt

|

|||

user_data/*

|

||||

!user_data/strategy/sample_strategy.py

|

||||

!user_data/notebooks

|

||||

!user_data/models

|

||||

!user_data/freqaimodels

|

||||

user_data/freqaimodels/*

|

||||

user_data/models/*

|

||||

user_data/notebooks/*

|

||||

freqtrade-plot.html

|

||||

freqtrade-profit-plot.html

|

||||

freqtrade/rpc/api_server/ui/*

|

||||

build_helpers/ta-lib/*

|

||||

|

||||

# Macos related

|

||||

.DS_Store

|

||||

|

|

@ -85,8 +80,6 @@ instance/

|

|||

|

||||

# Sphinx documentation

|

||||

docs/_build/

|

||||

# Mkdocs documentation

|

||||

site/

|

||||

|

||||

# PyBuilder

|

||||

target/

|

||||

|

|

@ -109,6 +102,6 @@ target/

|

|||

!*.gitkeep

|

||||

!config_examples/config_binance.example.json

|

||||

!config_examples/config_bittrex.example.json

|

||||

!config_examples/config_ftx.example.json

|

||||

!config_examples/config_full.example.json

|

||||

!config_examples/config_kraken.example.json

|

||||

!config_examples/config_freqai.example.json

|

||||

|

|

|

|||

|

|

@ -1,55 +0,0 @@

|

|||

# See https://pre-commit.com for more information

|

||||

# See https://pre-commit.com/hooks.html for more hooks

|

||||

repos:

|

||||

- repo: https://github.com/pycqa/flake8

|

||||

rev: "6.0.0"

|

||||

hooks:

|

||||

- id: flake8

|

||||

# stages: [push]

|

||||

|

||||

- repo: https://github.com/pre-commit/mirrors-mypy

|

||||

rev: "v1.0.1"

|

||||

hooks:

|

||||

- id: mypy

|

||||

exclude: build_helpers

|

||||

additional_dependencies:

|

||||

- types-cachetools==5.3.0.5

|

||||

- types-filelock==3.2.7

|

||||

- types-requests==2.28.11.17

|

||||

- types-tabulate==0.9.0.2

|

||||

- types-python-dateutil==2.8.19.12

|

||||

- SQLAlchemy==2.0.9

|

||||

# stages: [push]

|

||||

|

||||

- repo: https://github.com/pycqa/isort

|

||||

rev: "5.12.0"

|

||||

hooks:

|

||||

- id: isort

|

||||

name: isort (python)

|

||||

# stages: [push]

|

||||

|

||||

- repo: https://github.com/charliermarsh/ruff-pre-commit

|

||||

# Ruff version.

|

||||

rev: 'v0.0.255'

|

||||

hooks:

|

||||

- id: ruff

|

||||

|

||||

- repo: https://github.com/pre-commit/pre-commit-hooks

|

||||

rev: v4.4.0

|

||||

hooks:

|

||||

- id: end-of-file-fixer

|

||||

exclude: |

|

||||

(?x)^(

|

||||

tests/.*|

|

||||

.*\.svg|

|

||||

.*\.yml|

|

||||

.*\.json

|

||||

)$

|

||||

- id: mixed-line-ending

|

||||

- id: debug-statements

|

||||

- id: check-ast

|

||||

- id: trailing-whitespace

|

||||

exclude: |

|

||||

(?x)^(

|

||||

.*\.md

|

||||

)$

|

||||

|

|

@ -7,3 +7,4 @@ ignore=vendor

|

|||

|

||||

[TYPECHECK]

|

||||

ignored-modules=numpy,talib,talib.abstract

|

||||

|

||||

|

|

|

|||

|

|

@ -45,17 +45,16 @@ pytest tests/test_<file_name>.py::test_<method_name>

|

|||

|

||||

### 2. Test if your code is PEP8 compliant

|

||||

|

||||

#### Run Ruff

|

||||

#### Run Flake8

|

||||

|

||||

```bash

|

||||

ruff .

|

||||

flake8 freqtrade tests scripts

|

||||

```

|

||||

|

||||

We receive a lot of code that fails the `ruff` checks.

|

||||

We receive a lot of code that fails the `flake8` checks.

|

||||

To help with that, we encourage you to install the git pre-commit

|

||||

hook that will warn you when you try to commit code that fails these checks.

|

||||

|

||||

you can manually run pre-commit with `pre-commit run -a`.

|

||||

hook that will warn you when you try to commit code that fails these checks.

|

||||

Guide for installing them is [here](http://flake8.pycqa.org/en/latest/user/using-hooks.html).

|

||||

|

||||

##### Additional styles applied

|

||||

|

||||

|

|

|

|||

|

|

@ -1,4 +1,4 @@

|

|||

FROM python:3.10.11-slim-bullseye as base

|

||||

FROM python:3.9.9-slim-bullseye as base

|

||||

|

||||

# Setup env

|

||||

ENV LANG C.UTF-8

|

||||

|

|

@ -11,7 +11,7 @@ ENV FT_APP_ENV="docker"

|

|||

# Prepare environment

|

||||

RUN mkdir /freqtrade \

|

||||

&& apt-get update \

|

||||

&& apt-get -y install sudo libatlas3-base curl sqlite3 libhdf5-serial-dev libgomp1 \

|

||||

&& apt-get -y install sudo libatlas3-base curl sqlite3 libhdf5-serial-dev \

|

||||

&& apt-get clean \

|

||||

&& useradd -u 1000 -G sudo -U -m -s /bin/bash ftuser \

|

||||

&& chown ftuser:ftuser /freqtrade \

|

||||

|

|

|

|||

|

|

@ -2,6 +2,5 @@ include LICENSE

|

|||

include README.md

|

||||

recursive-include freqtrade *.py

|

||||

recursive-include freqtrade/templates/ *.j2 *.ipynb

|

||||

include freqtrade/exchange/binance_leverage_tiers.json

|

||||

include freqtrade/rpc/api_server/ui/fallback_file.html

|

||||

include freqtrade/rpc/api_server/ui/favicon.ico

|

||||

|

|

|

|||

42

README.md

|

|

@ -1,7 +1,6 @@

|

|||

#

|

||||

|

||||

[](https://github.com/freqtrade/freqtrade/actions/)

|

||||

[](https://doi.org/10.21105/joss.04864)

|

||||

[](https://coveralls.io/github/freqtrade/freqtrade?branch=develop)

|

||||

[](https://www.freqtrade.io)

|

||||

[](https://codeclimate.com/github/freqtrade/freqtrade/maintainability)

|

||||

|

|

@ -10,6 +9,10 @@ Freqtrade is a free and open source crypto trading bot written in Python. It is

|

|||

|

||||

|

||||

|

||||

## Sponsored promotion

|

||||

|

||||

[](https://tokenbot.com/?utm_source=github&utm_medium=freqtrade&utm_campaign=algodevs)

|

||||

|

||||

## Disclaimer

|

||||

|

||||

This software is for educational purposes only. Do not risk money which

|

||||

|

|

@ -27,23 +30,14 @@ hesitate to read the source code and understand the mechanism of this bot.

|

|||

|

||||

Please read the [exchange specific notes](docs/exchanges.md) to learn about eventual, special configurations needed for each exchange.

|

||||

|

||||

- [X] [Binance](https://www.binance.com/)

|

||||

- [X] [Binance](https://www.binance.com/) ([*Note for binance users](docs/exchanges.md#binance-blacklist))

|

||||

- [X] [Bittrex](https://bittrex.com/)

|

||||

- [X] [FTX](https://ftx.com)

|

||||

- [X] [Gate.io](https://www.gate.io/ref/6266643)

|

||||

- [X] [Huobi](http://huobi.com/)

|

||||

- [X] [Kraken](https://kraken.com/)

|

||||

- [X] [OKX](https://okx.com/) (Former OKEX)

|

||||

- [X] [OKX](https://www.okx.com/)

|

||||

- [ ] [potentially many others](https://github.com/ccxt/ccxt/). _(We cannot guarantee they will work)_

|

||||

|

||||

### Supported Futures Exchanges (experimental)

|

||||

|

||||

- [X] [Binance](https://www.binance.com/)

|

||||

- [X] [Gate.io](https://www.gate.io/ref/6266643)

|

||||

- [X] [OKX](https://okx.com/)

|

||||

- [X] [Bybit](https://bybit.com/)

|

||||

|

||||

Please make sure to read the [exchange specific notes](docs/exchanges.md), as well as the [trading with leverage](docs/leverage.md) documentation before diving in.

|

||||

|

||||

### Community tested

|

||||

|

||||

Exchanges confirmed working by the community:

|

||||

|

|

@ -64,7 +58,6 @@ Please find the complete documentation on the [freqtrade website](https://www.fr

|

|||

- [x] **Dry-run**: Run the bot without paying money.

|

||||

- [x] **Backtesting**: Run a simulation of your buy/sell strategy.

|

||||

- [x] **Strategy Optimization by machine learning**: Use machine learning to optimize your buy/sell strategy parameters with real exchange data.

|

||||

- [X] **Adaptive prediction modeling**: Build a smart strategy with FreqAI that self-trains to the market via adaptive machine learning methods. [Learn more](https://www.freqtrade.io/en/stable/freqai/)

|

||||

- [x] **Edge position sizing** Calculate your win rate, risk reward ratio, the best stoploss and adjust your position size before taking a position for each specific market. [Learn more](https://www.freqtrade.io/en/stable/edge/).

|

||||

- [x] **Whitelist crypto-currencies**: Select which crypto-currency you want to trade or use dynamic whitelists.

|

||||

- [x] **Blacklist crypto-currencies**: Select which crypto-currency you want to avoid.

|

||||

|

|

@ -75,9 +68,15 @@ Please find the complete documentation on the [freqtrade website](https://www.fr

|

|||

|

||||

## Quick start

|

||||

|

||||

Please refer to the [Docker Quickstart documentation](https://www.freqtrade.io/en/stable/docker_quickstart/) on how to get started quickly.

|

||||

Freqtrade provides a Linux/macOS script to install all dependencies and help you to configure the bot.

|

||||

|

||||

For further (native) installation methods, please refer to the [Installation documentation page](https://www.freqtrade.io/en/stable/installation/).

|

||||

```bash

|

||||

git clone -b develop https://github.com/freqtrade/freqtrade.git

|

||||

cd freqtrade

|

||||

./setup.sh --install

|

||||

```

|

||||

|

||||

For any other type of installation please refer to [Installation doc](https://www.freqtrade.io/en/stable/installation/).

|

||||

|

||||

## Basic Usage

|

||||

|

||||

|

|

@ -131,11 +130,10 @@ Telegram is not mandatory. However, this is a great way to control your bot. Mor

|

|||

|

||||

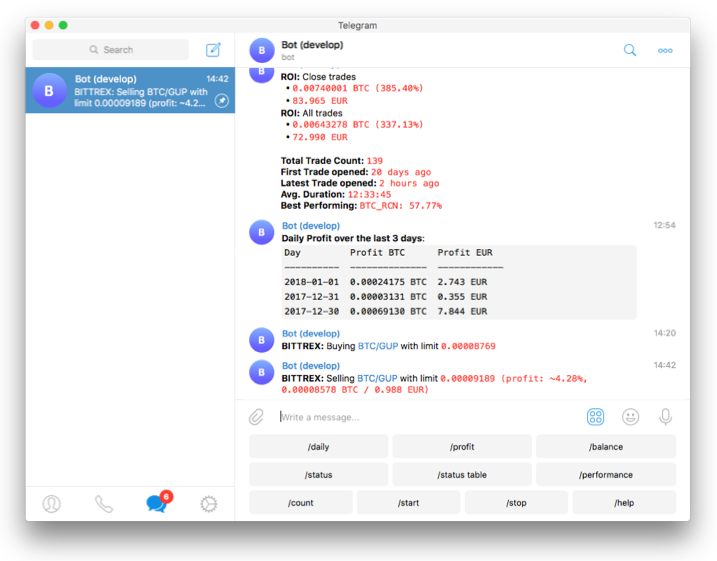

- `/start`: Starts the trader.

|

||||

- `/stop`: Stops the trader.

|

||||

- `/stopentry`: Stop entering new trades.

|

||||

- `/stopbuy`: Stop entering new trades.

|

||||

- `/status <trade_id>|[table]`: Lists all or specific open trades.

|

||||

- `/profit [<n>]`: Lists cumulative profit from all finished trades, over the last n days.

|

||||

- `/forceexit <trade_id>|all`: Instantly exits the given trade (Ignoring `minimum_roi`).

|

||||

- `/fx <trade_id>|all`: Alias to `/forceexit`

|

||||

- `/forcesell <trade_id>|all`: Instantly sells the given trade (Ignoring `minimum_roi`).

|

||||

- `/performance`: Show performance of each finished trade grouped by pair

|

||||

- `/balance`: Show account balance per currency.

|

||||

- `/daily <n>`: Shows profit or loss per day, over the last n days.

|

||||

|

|

@ -165,10 +163,6 @@ first. If it hasn't been reported, please

|

|||

ensure you follow the template guide so that the team can assist you as

|

||||

quickly as possible.

|

||||

|

||||

For every [issue](https://github.com/freqtrade/freqtrade/issues/new/choose) created, kindly follow up and mark satisfaction or reminder to close issue when equilibrium ground is reached.

|

||||

|

||||

--Maintain github's [community policy](https://docs.github.com/en/site-policy/github-terms/github-community-code-of-conduct)--

|

||||

|

||||

### [Feature Requests](https://github.com/freqtrade/freqtrade/labels/enhancement)

|

||||

|

||||

Have you a great idea to improve the bot you want to share? Please,

|

||||

|

|

@ -199,7 +193,7 @@ Issues labeled [good first issue](https://github.com/freqtrade/freqtrade/labels/

|

|||

|

||||

The clock must be accurate, synchronized to a NTP server very frequently to avoid problems with communication to the exchanges.

|

||||

|

||||

### Minimum hardware required

|

||||

### Min hardware required

|

||||

|

||||

To run this bot we recommend you a cloud instance with a minimum of:

|

||||

|

||||

|

|

|

|||

|

|

@ -4,12 +4,12 @@ else

|

|||

INSTALL_LOC=${1}

|

||||

fi

|

||||

echo "Installing to ${INSTALL_LOC}"

|

||||

if [ -n "$2" ] || [ ! -f "${INSTALL_LOC}/lib/libta_lib.a" ]; then

|

||||

if [ ! -f "${INSTALL_LOC}/lib/libta_lib.a" ]; then

|

||||

tar zxvf ta-lib-0.4.0-src.tar.gz

|

||||

cd ta-lib \

|

||||

&& sed -i.bak "s|0.00000001|0.000000000000000001 |g" src/ta_func/ta_utility.h \

|

||||

&& curl 'https://raw.githubusercontent.com/gcc-mirror/gcc/master/config.guess' -o config.guess \

|

||||

&& curl 'https://raw.githubusercontent.com/gcc-mirror/gcc/master/config.sub' -o config.sub \

|

||||

&& curl 'http://git.savannah.gnu.org/gitweb/?p=config.git;a=blob_plain;f=config.guess;hb=HEAD' -o config.guess \

|

||||

&& curl 'http://git.savannah.gnu.org/gitweb/?p=config.git;a=blob_plain;f=config.sub;hb=HEAD' -o config.sub \

|

||||

&& ./configure --prefix=${INSTALL_LOC}/ \

|

||||

&& make

|

||||

if [ $? -ne 0 ]; then

|

||||

|

|

@ -17,17 +17,11 @@ if [ -n "$2" ] || [ ! -f "${INSTALL_LOC}/lib/libta_lib.a" ]; then

|

|||

cd .. && rm -rf ./ta-lib/

|

||||

exit 1

|

||||

fi

|

||||

if [ -z "$2" ]; then

|

||||

which sudo && sudo make install || make install

|

||||

if [ -x "$(command -v apt-get)" ]; then

|

||||

echo "Updating library path using ldconfig"

|

||||

sudo ldconfig

|

||||

fi

|

||||

else

|

||||

# Don't install with sudo

|

||||

make install

|

||||

which sudo && sudo make install || make install

|

||||

if [ -x "$(command -v apt-get)" ]; then

|

||||

echo "Updating library path using ldconfig"

|

||||

sudo ldconfig

|

||||

fi

|

||||

|

||||

cd .. && rm -rf ./ta-lib/

|

||||

else

|

||||

echo "TA-lib already installed, skipping installation"

|

||||

|

|

|

|||

|

|

@ -6,16 +6,13 @@ python -m pip install --upgrade pip wheel

|

|||

$pyv = python -c "import sys; print(f'{sys.version_info.major}.{sys.version_info.minor}')"

|

||||

|

||||

if ($pyv -eq '3.8') {

|

||||

pip install build_helpers\TA_Lib-0.4.25-cp38-cp38-win_amd64.whl

|

||||

pip install build_helpers\TA_Lib-0.4.24-cp38-cp38-win_amd64.whl

|

||||

}

|

||||

if ($pyv -eq '3.9') {

|

||||

pip install build_helpers\TA_Lib-0.4.25-cp39-cp39-win_amd64.whl

|

||||

pip install build_helpers\TA_Lib-0.4.24-cp39-cp39-win_amd64.whl

|

||||

}

|

||||

if ($pyv -eq '3.10') {

|

||||

pip install build_helpers\TA_Lib-0.4.25-cp310-cp310-win_amd64.whl

|

||||

}

|

||||

if ($pyv -eq '3.11') {

|

||||

pip install build_helpers\TA_Lib-0.4.25-cp311-cp311-win_amd64.whl

|

||||

pip install build_helpers\TA_Lib-0.4.24-cp310-cp310-win_amd64.whl

|

||||

}

|

||||

pip install -r requirements-dev.txt

|

||||

pip install -e .

|

||||

|

|

|

|||

|

|

@ -1,47 +0,0 @@

|

|||

# File used in CI to ensure pre-commit dependencies are kept uptodate.

|

||||

|

||||

import sys

|

||||

from pathlib import Path

|

||||

|

||||

import yaml

|

||||

|

||||

|

||||

pre_commit_file = Path('.pre-commit-config.yaml')

|

||||

require_dev = Path('requirements-dev.txt')

|

||||

require = Path('requirements.txt')

|

||||

|

||||

with require_dev.open('r') as rfile:

|

||||

requirements = rfile.readlines()

|

||||

|

||||

with require.open('r') as rfile:

|

||||

requirements.extend(rfile.readlines())

|

||||

|

||||

# Extract types only

|

||||

type_reqs = [r.strip('\n') for r in requirements if r.startswith(

|

||||

'types-') or r.startswith('SQLAlchemy')]

|

||||

|

||||

with pre_commit_file.open('r') as file:

|

||||

f = yaml.load(file, Loader=yaml.FullLoader)

|

||||

|

||||

|

||||

mypy_repo = [repo for repo in f['repos'] if repo['repo']

|

||||

== 'https://github.com/pre-commit/mirrors-mypy']

|

||||

|

||||

hooks = mypy_repo[0]['hooks'][0]['additional_dependencies']

|

||||

|

||||

errors = []

|

||||

for hook in hooks:

|

||||

if hook not in type_reqs:

|

||||

errors.append(f"{hook} is missing in requirements-dev.txt.")

|

||||

|

||||

for req in type_reqs:

|

||||

if req not in hooks:

|

||||

errors.append(f"{req} is missing in pre-config file.")

|

||||

|

||||

|

||||

if errors:

|

||||

for e in errors:

|

||||

print(e)

|

||||

sys.exit(1)

|

||||

|

||||

sys.exit(0)

|

||||

|

|

@ -3,22 +3,14 @@

|

|||

# Use BuildKit, otherwise building on ARM fails

|

||||

export DOCKER_BUILDKIT=1

|

||||

|

||||

IMAGE_NAME=freqtradeorg/freqtrade

|

||||

CACHE_IMAGE=freqtradeorg/freqtrade_cache

|

||||

GHCR_IMAGE_NAME=ghcr.io/freqtrade/freqtrade

|

||||

|

||||

# Replace / with _ to create a valid tag

|

||||

TAG=$(echo "${BRANCH_NAME}" | sed -e "s/\//_/g")

|

||||

TAG_PLOT=${TAG}_plot

|

||||

TAG_FREQAI=${TAG}_freqai

|

||||

TAG_FREQAI_RL=${TAG_FREQAI}rl

|

||||

TAG_FREQAI_TORCH=${TAG_FREQAI}torch

|

||||

TAG_PI="${TAG}_pi"

|

||||

|

||||

TAG_ARM=${TAG}_arm

|

||||

TAG_PLOT_ARM=${TAG_PLOT}_arm

|

||||

TAG_FREQAI_ARM=${TAG_FREQAI}_arm

|

||||

TAG_FREQAI_RL_ARM=${TAG_FREQAI_RL}_arm

|

||||

CACHE_IMAGE=freqtradeorg/freqtrade_cache

|

||||

|

||||

echo "Running for ${TAG}"

|

||||

|

||||

|

|

@ -42,19 +34,15 @@ if [ $? -ne 0 ]; then

|

|||

echo "failed building multiarch images"

|

||||

return 1

|

||||

fi

|

||||

|

||||

docker build --build-arg sourceimage=freqtrade --build-arg sourcetag=${TAG_ARM} -t freqtrade:${TAG_PLOT_ARM} -f docker/Dockerfile.plot .

|

||||

docker build --build-arg sourceimage=freqtrade --build-arg sourcetag=${TAG_ARM} -t freqtrade:${TAG_FREQAI_ARM} -f docker/Dockerfile.freqai .

|

||||

docker build --build-arg sourceimage=freqtrade --build-arg sourcetag=${TAG_FREQAI_ARM} -t freqtrade:${TAG_FREQAI_RL_ARM} -f docker/Dockerfile.freqai_rl .

|

||||

|

||||

# Tag image for upload and next build step

|

||||

docker tag freqtrade:$TAG_ARM ${CACHE_IMAGE}:$TAG_ARM

|

||||

|

||||

docker build --cache-from freqtrade:${TAG_ARM} --build-arg sourceimage=${CACHE_IMAGE} --build-arg sourcetag=${TAG_ARM} -t freqtrade:${TAG_PLOT_ARM} -f docker/Dockerfile.plot .

|

||||

|

||||

docker tag freqtrade:$TAG_PLOT_ARM ${CACHE_IMAGE}:$TAG_PLOT_ARM

|

||||

docker tag freqtrade:$TAG_FREQAI_ARM ${CACHE_IMAGE}:$TAG_FREQAI_ARM

|

||||

docker tag freqtrade:$TAG_FREQAI_RL_ARM ${CACHE_IMAGE}:$TAG_FREQAI_RL_ARM

|

||||

|

||||

# Run backtest

|

||||

docker run --rm -v $(pwd)/config_examples/config_bittrex.example.json:/freqtrade/config.json:ro -v $(pwd)/tests:/tests freqtrade:${TAG_ARM} backtesting --datadir /tests/testdata --strategy-path /tests/strategy/strats/ --strategy StrategyTestV3

|

||||

docker run --rm -v $(pwd)/config_examples/config_bittrex.example.json:/freqtrade/config.json:ro -v $(pwd)/tests:/tests freqtrade:${TAG_ARM} backtesting --datadir /tests/testdata --strategy-path /tests/strategy/strats/ --strategy StrategyTestV2

|

||||

|

||||

if [ $? -ne 0 ]; then

|

||||

echo "failed running backtest"

|

||||

|

|

@ -63,9 +51,8 @@ fi

|

|||

|

||||

docker images

|

||||

|

||||

# docker push ${IMAGE_NAME}

|

||||

docker push ${CACHE_IMAGE}:$TAG_PLOT_ARM

|

||||

docker push ${CACHE_IMAGE}:$TAG_FREQAI_ARM

|

||||

docker push ${CACHE_IMAGE}:$TAG_FREQAI_RL_ARM

|

||||

docker push ${CACHE_IMAGE}:$TAG_ARM

|

||||

|

||||

# Create multi-arch image

|

||||

|

|

@ -73,47 +60,19 @@ docker push ${CACHE_IMAGE}:$TAG_ARM

|

|||

# Otherwise installation might fail.

|

||||

echo "create manifests"

|

||||

|

||||

docker manifest create ${IMAGE_NAME}:${TAG} ${CACHE_IMAGE}:${TAG} ${CACHE_IMAGE}:${TAG_ARM} ${IMAGE_NAME}:${TAG_PI}

|

||||

docker manifest create --amend ${IMAGE_NAME}:${TAG} ${CACHE_IMAGE}:${TAG_ARM} ${IMAGE_NAME}:${TAG_PI} ${CACHE_IMAGE}:${TAG}

|

||||

docker manifest push -p ${IMAGE_NAME}:${TAG}

|

||||

|

||||

docker manifest create ${IMAGE_NAME}:${TAG_PLOT} ${CACHE_IMAGE}:${TAG_PLOT} ${CACHE_IMAGE}:${TAG_PLOT_ARM}

|

||||

docker manifest create ${IMAGE_NAME}:${TAG_PLOT} ${CACHE_IMAGE}:${TAG_PLOT_ARM} ${CACHE_IMAGE}:${TAG_PLOT}

|

||||

docker manifest push -p ${IMAGE_NAME}:${TAG_PLOT}

|

||||

|

||||

docker manifest create ${IMAGE_NAME}:${TAG_FREQAI} ${CACHE_IMAGE}:${TAG_FREQAI} ${CACHE_IMAGE}:${TAG_FREQAI_ARM}

|

||||

docker manifest push -p ${IMAGE_NAME}:${TAG_FREQAI}

|

||||

|

||||

docker manifest create ${IMAGE_NAME}:${TAG_FREQAI_RL} ${CACHE_IMAGE}:${TAG_FREQAI_RL} ${CACHE_IMAGE}:${TAG_FREQAI_RL_ARM}

|

||||

docker manifest push -p ${IMAGE_NAME}:${TAG_FREQAI_RL}

|

||||

|

||||

# Create special Torch tag - which is identical to the RL tag.

|

||||

docker manifest create ${IMAGE_NAME}:${TAG_FREQAI_TORCH} ${CACHE_IMAGE}:${TAG_FREQAI_RL} ${CACHE_IMAGE}:${TAG_FREQAI_RL_ARM}

|

||||

docker manifest push -p ${IMAGE_NAME}:${TAG_FREQAI_TORCH}

|

||||

|

||||

# copy images to ghcr.io

|

||||

|

||||

alias crane="docker run --rm -i -v $(pwd)/.crane:/home/nonroot/.docker/ gcr.io/go-containerregistry/crane"

|

||||

mkdir .crane

|

||||

chmod a+rwx .crane

|

||||

|

||||

echo "${GHCR_TOKEN}" | crane auth login ghcr.io -u "${GHCR_USERNAME}" --password-stdin

|

||||

|

||||

crane copy ${IMAGE_NAME}:${TAG_FREQAI_RL} ${GHCR_IMAGE_NAME}:${TAG_FREQAI_RL}

|

||||

crane copy ${IMAGE_NAME}:${TAG_FREQAI_RL} ${GHCR_IMAGE_NAME}:${TAG_FREQAI_TORCH}

|

||||

crane copy ${IMAGE_NAME}:${TAG_FREQAI} ${GHCR_IMAGE_NAME}:${TAG_FREQAI}

|

||||

crane copy ${IMAGE_NAME}:${TAG_PLOT} ${GHCR_IMAGE_NAME}:${TAG_PLOT}

|

||||

crane copy ${IMAGE_NAME}:${TAG} ${GHCR_IMAGE_NAME}:${TAG}

|

||||

|

||||

# Tag as latest for develop builds

|

||||

if [ "${TAG}" = "develop" ]; then

|

||||

echo 'Tagging image as latest'

|

||||

docker manifest create ${IMAGE_NAME}:latest ${CACHE_IMAGE}:${TAG_ARM} ${IMAGE_NAME}:${TAG_PI} ${CACHE_IMAGE}:${TAG}

|

||||

docker manifest push -p ${IMAGE_NAME}:latest

|

||||

|

||||

crane copy ${IMAGE_NAME}:latest ${GHCR_IMAGE_NAME}:latest

|

||||

fi

|

||||

|

||||

docker images

|

||||

rm -rf .crane

|

||||

|

||||

# Cleanup old images from arm64 node.

|

||||

docker image prune -a --force --filter "until=24h"

|

||||

|

|

|

|||

|

|

@ -2,17 +2,14 @@

|

|||

|

||||

# The below assumes a correctly setup docker buildx environment

|

||||

|

||||

IMAGE_NAME=freqtradeorg/freqtrade

|

||||

CACHE_IMAGE=freqtradeorg/freqtrade_cache

|

||||

# Replace / with _ to create a valid tag

|

||||

TAG=$(echo "${BRANCH_NAME}" | sed -e "s/\//_/g")

|

||||

TAG_PLOT=${TAG}_plot

|

||||

TAG_FREQAI=${TAG}_freqai

|

||||

TAG_FREQAI_RL=${TAG_FREQAI}rl

|

||||

TAG_PI="${TAG}_pi"

|

||||

|

||||

PI_PLATFORM="linux/arm/v7"

|

||||

echo "Running for ${TAG}"

|

||||

CACHE_IMAGE=freqtradeorg/freqtrade_cache

|

||||

CACHE_TAG=${CACHE_IMAGE}:${TAG_PI}_cache

|

||||

|

||||

# Add commit and commit_message to docker container

|

||||

|

|

@ -27,10 +24,7 @@ if [ "${GITHUB_EVENT_NAME}" = "schedule" ]; then

|

|||

--cache-to=type=registry,ref=${CACHE_TAG} \

|

||||

-f docker/Dockerfile.armhf \

|

||||

--platform ${PI_PLATFORM} \

|

||||

-t ${IMAGE_NAME}:${TAG_PI} \

|

||||

--push \

|

||||

--provenance=false \

|

||||

.

|

||||

-t ${IMAGE_NAME}:${TAG_PI} --push .

|

||||

else

|

||||

echo "event ${GITHUB_EVENT_NAME}: building with cache"

|

||||

# Build regular image

|

||||

|

|

@ -39,16 +33,12 @@ else

|

|||

|

||||

# Pull last build to avoid rebuilding the whole image

|

||||

# docker pull --platform ${PI_PLATFORM} ${IMAGE_NAME}:${TAG}

|

||||

# disable provenance due to https://github.com/docker/buildx/issues/1509

|

||||

docker buildx build \

|

||||

--cache-from=type=registry,ref=${CACHE_TAG} \

|

||||

--cache-to=type=registry,ref=${CACHE_TAG} \

|

||||

-f docker/Dockerfile.armhf \

|

||||

--platform ${PI_PLATFORM} \

|

||||

-t ${IMAGE_NAME}:${TAG_PI} \

|

||||

--push \

|

||||

--provenance=false \

|

||||

.

|

||||

-t ${IMAGE_NAME}:${TAG_PI} --push .

|

||||

fi

|

||||

|

||||

if [ $? -ne 0 ]; then

|

||||

|

|

@ -58,16 +48,12 @@ fi

|

|||

# Tag image for upload and next build step

|

||||

docker tag freqtrade:$TAG ${CACHE_IMAGE}:$TAG

|

||||

|

||||

docker build --build-arg sourceimage=freqtrade --build-arg sourcetag=${TAG} -t freqtrade:${TAG_PLOT} -f docker/Dockerfile.plot .

|

||||

docker build --build-arg sourceimage=freqtrade --build-arg sourcetag=${TAG} -t freqtrade:${TAG_FREQAI} -f docker/Dockerfile.freqai .

|

||||

docker build --build-arg sourceimage=freqtrade --build-arg sourcetag=${TAG_FREQAI} -t freqtrade:${TAG_FREQAI_RL} -f docker/Dockerfile.freqai_rl .

|

||||

docker build --cache-from freqtrade:${TAG} --build-arg sourceimage=${CACHE_IMAGE} --build-arg sourcetag=${TAG} -t freqtrade:${TAG_PLOT} -f docker/Dockerfile.plot .

|

||||

|

||||

docker tag freqtrade:$TAG_PLOT ${CACHE_IMAGE}:$TAG_PLOT

|

||||

docker tag freqtrade:$TAG_FREQAI ${CACHE_IMAGE}:$TAG_FREQAI

|

||||

docker tag freqtrade:$TAG_FREQAI_RL ${CACHE_IMAGE}:$TAG_FREQAI_RL

|

||||

|

||||

# Run backtest

|

||||

docker run --rm -v $(pwd)/config_examples/config_bittrex.example.json:/freqtrade/config.json:ro -v $(pwd)/tests:/tests freqtrade:${TAG} backtesting --datadir /tests/testdata --strategy-path /tests/strategy/strats/ --strategy StrategyTestV3

|

||||

docker run --rm -v $(pwd)/config_examples/config_bittrex.example.json:/freqtrade/config.json:ro -v $(pwd)/tests:/tests freqtrade:${TAG} backtesting --datadir /tests/testdata --strategy-path /tests/strategy/strats/ --strategy StrategyTestV2

|

||||

|

||||

if [ $? -ne 0 ]; then

|

||||

echo "failed running backtest"

|

||||

|

|

@ -76,10 +62,10 @@ fi

|

|||

|

||||

docker images

|

||||

|

||||

docker push ${CACHE_IMAGE}:$TAG

|

||||

docker push ${CACHE_IMAGE}

|

||||

docker push ${CACHE_IMAGE}:$TAG_PLOT

|

||||

docker push ${CACHE_IMAGE}:$TAG_FREQAI

|

||||

docker push ${CACHE_IMAGE}:$TAG_FREQAI_RL

|

||||

docker push ${CACHE_IMAGE}:$TAG

|

||||

|

||||

|

||||

docker images

|

||||

|

||||

|

|

|

|||

|

|

@ -8,23 +8,21 @@

|

|||

"dry_run": true,

|

||||

"cancel_open_orders_on_exit": false,

|

||||

"unfilledtimeout": {

|

||||

"entry": 10,

|

||||

"exit": 10,

|

||||

"buy": 10,

|

||||

"sell": 10,

|

||||

"exit_timeout_count": 0,

|

||||

"unit": "minutes"

|

||||

},

|

||||

"entry_pricing": {

|

||||

"price_side": "same",

|

||||

"bid_strategy": {

|

||||

"ask_last_balance": 0.0,

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1,

|

||||

"price_last_balance": 0.0,

|

||||

"check_depth_of_market": {

|

||||

"enabled": false,

|

||||

"bids_to_ask_delta": 1

|

||||

}

|

||||

},

|

||||

"exit_pricing": {

|

||||

"price_side": "same",

|

||||

"ask_strategy": {

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1

|

||||

},

|

||||

|

|

@ -53,12 +51,26 @@

|

|||

"XTZ/BTC"

|

||||

],

|

||||

"pair_blacklist": [

|

||||

"BNB/.*"

|

||||

"BNB/BTC"

|

||||

]

|

||||

},

|

||||

"pairlists": [

|

||||

{"method": "StaticPairList"}

|

||||

],

|

||||

"edge": {

|

||||

"enabled": false,

|

||||

"process_throttle_secs": 3600,

|

||||

"calculate_since_number_of_days": 7,

|

||||

"allowed_risk": 0.01,

|

||||

"stoploss_range_min": -0.01,

|

||||

"stoploss_range_max": -0.1,

|

||||

"stoploss_range_step": -0.01,

|

||||

"minimum_winrate": 0.60,

|

||||

"minimum_expectancy": 0.20,

|

||||

"min_trade_number": 10,

|

||||

"max_trade_duration_minute": 1440,

|

||||

"remove_pumps": false

|

||||

},

|

||||

"telegram": {

|

||||

"enabled": false,

|

||||

"token": "your_telegram_token",

|

||||

|

|

@ -76,7 +88,7 @@

|

|||

},

|

||||

"bot_name": "freqtrade",

|

||||

"initial_state": "running",

|

||||

"force_entry_enable": false,

|

||||

"forcebuy_enable": false,

|

||||

"internals": {

|

||||

"process_throttle_secs": 5

|

||||

}

|

||||

|

|

|

|||

|

|

@ -8,23 +8,21 @@

|

|||

"dry_run": true,

|

||||

"cancel_open_orders_on_exit": false,

|

||||

"unfilledtimeout": {

|

||||

"entry": 10,

|

||||

"exit": 10,

|

||||

"buy": 10,

|

||||

"sell": 10,

|

||||

"exit_timeout_count": 0,

|

||||

"unit": "minutes"

|

||||

},

|

||||

"entry_pricing": {

|

||||

"price_side": "same",

|

||||

"bid_strategy": {

|

||||

"use_order_book": true,

|

||||

"ask_last_balance": 0.0,

|

||||

"order_book_top": 1,

|

||||

"price_last_balance": 0.0,

|

||||

"check_depth_of_market": {

|

||||

"enabled": false,

|

||||

"bids_to_ask_delta": 1

|

||||

}

|

||||

},

|

||||

"exit_pricing":{

|

||||

"price_side": "same",

|

||||

"ask_strategy":{

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1

|

||||

},

|

||||

|

|

@ -56,6 +54,20 @@

|

|||

"pairlists": [

|

||||

{"method": "StaticPairList"}

|

||||

],

|

||||

"edge": {

|

||||

"enabled": false,

|

||||

"process_throttle_secs": 3600,

|

||||

"calculate_since_number_of_days": 7,

|

||||

"allowed_risk": 0.01,

|

||||

"stoploss_range_min": -0.01,

|

||||

"stoploss_range_max": -0.1,

|

||||

"stoploss_range_step": -0.01,

|

||||

"minimum_winrate": 0.60,

|

||||

"minimum_expectancy": 0.20,

|

||||

"min_trade_number": 10,

|

||||

"max_trade_duration_minute": 1440,

|

||||

"remove_pumps": false

|

||||

},

|

||||

"telegram": {

|

||||

"enabled": false,

|

||||

"token": "your_telegram_token",

|

||||

|

|

@ -73,7 +85,7 @@

|

|||

},

|

||||

"bot_name": "freqtrade",

|

||||

"initial_state": "running",

|

||||

"force_entry_enable": false,

|

||||

"forcebuy_enable": false,

|

||||

"internals": {

|

||||

"process_throttle_secs": 5

|

||||

}

|

||||

|

|

|

|||

|

|

@ -1,90 +0,0 @@

|

|||

{

|

||||

"trading_mode": "futures",

|

||||

"margin_mode": "isolated",

|

||||

"max_open_trades": 5,

|

||||

"stake_currency": "USDT",

|

||||

"stake_amount": 200,

|

||||

"tradable_balance_ratio": 1,

|

||||

"fiat_display_currency": "USD",

|

||||

"dry_run": true,

|

||||

"timeframe": "3m",

|

||||

"dry_run_wallet": 1000,

|

||||

"cancel_open_orders_on_exit": true,

|

||||

"unfilledtimeout": {

|

||||

"entry": 10,

|

||||

"exit": 30

|

||||

},

|

||||

"exchange": {

|

||||

"name": "binance",

|

||||

"key": "",

|

||||

"secret": "",

|

||||

"ccxt_config": {},

|

||||

"ccxt_async_config": {},

|

||||

"pair_whitelist": [

|

||||

"1INCH/USDT:USDT",

|

||||

"ALGO/USDT:USDT"

|

||||

],

|

||||

"pair_blacklist": []

|

||||

},

|

||||

"entry_pricing": {

|

||||

"price_side": "same",

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1,

|

||||

"price_last_balance": 0.0,

|

||||

"check_depth_of_market": {

|

||||

"enabled": false,

|

||||

"bids_to_ask_delta": 1

|

||||

}

|

||||

},

|

||||

"exit_pricing": {

|

||||

"price_side": "other",

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1

|

||||

},

|

||||

"pairlists": [

|

||||

{

|

||||

"method": "StaticPairList"

|

||||

}

|

||||

],

|

||||

"freqai": {

|

||||

"enabled": true,

|

||||

"purge_old_models": 2,

|

||||

"train_period_days": 15,

|

||||

"backtest_period_days": 7,

|

||||

"live_retrain_hours": 0,

|

||||

"identifier": "uniqe-id",

|

||||

"feature_parameters": {

|

||||

"include_timeframes": [

|

||||

"3m",

|

||||

"15m",

|

||||

"1h"

|

||||

],

|

||||

"include_corr_pairlist": [

|

||||

"BTC/USDT:USDT",

|

||||

"ETH/USDT:USDT"

|

||||

],

|

||||

"label_period_candles": 20,

|

||||

"include_shifted_candles": 2,

|

||||

"DI_threshold": 0.9,

|

||||

"weight_factor": 0.9,

|

||||

"principal_component_analysis": false,

|

||||

"use_SVM_to_remove_outliers": true,

|

||||

"indicator_periods_candles": [

|

||||

10,

|

||||

20

|

||||

],

|

||||

"plot_feature_importances": 0

|

||||

},

|

||||

"data_split_parameters": {

|

||||

"test_size": 0.33,

|

||||

"random_state": 1

|

||||

},

|

||||

"model_training_parameters": {}

|

||||

},

|

||||

"bot_name": "",

|

||||

"force_entry_enable": true,

|

||||

"initial_state": "running",

|

||||

"internals": {

|

||||

"process_throttle_secs": 5

|

||||

}

|

||||

}

|

||||

|

|

@ -0,0 +1,94 @@

|

|||

{

|

||||

"max_open_trades": 3,

|

||||

"stake_currency": "USD",

|

||||

"stake_amount": 50,

|

||||

"tradable_balance_ratio": 0.99,

|

||||

"fiat_display_currency": "USD",

|

||||

"timeframe": "5m",

|

||||

"dry_run": true,

|

||||

"cancel_open_orders_on_exit": false,

|

||||

"unfilledtimeout": {

|

||||

"buy": 10,

|

||||

"sell": 10,

|

||||

"exit_timeout_count": 0,

|

||||

"unit": "minutes"

|

||||

},

|

||||

"bid_strategy": {

|

||||

"ask_last_balance": 0.0,

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1,

|

||||

"check_depth_of_market": {

|

||||

"enabled": false,

|

||||

"bids_to_ask_delta": 1

|

||||

}

|

||||

},

|

||||

"ask_strategy": {

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1

|

||||

},

|

||||

"exchange": {

|

||||

"name": "ftx",

|

||||

"key": "your_exchange_key",

|

||||

"secret": "your_exchange_secret",

|

||||

"ccxt_config": {},

|

||||

"ccxt_async_config": {},

|

||||

"pair_whitelist": [

|

||||

"BTC/USD",

|

||||

"ETH/USD",

|

||||

"BNB/USD",

|

||||

"USDT/USD",

|

||||

"LTC/USD",

|

||||

"SRM/USD",

|

||||

"SXP/USD",

|

||||

"XRP/USD",

|

||||

"DOGE/USD",

|

||||

"1INCH/USD",

|

||||

"CHZ/USD",

|

||||

"MATIC/USD",

|

||||

"LINK/USD",

|

||||

"OXY/USD",

|

||||

"SUSHI/USD"

|

||||

],

|

||||

"pair_blacklist": [

|

||||

"FTT/USD"

|

||||

]

|

||||

},

|

||||

"pairlists": [

|

||||

{"method": "StaticPairList"}

|

||||

],

|

||||

"edge": {

|

||||

"enabled": false,

|

||||

"process_throttle_secs": 3600,

|

||||

"calculate_since_number_of_days": 7,

|

||||

"allowed_risk": 0.01,

|

||||

"stoploss_range_min": -0.01,

|

||||

"stoploss_range_max": -0.1,

|

||||

"stoploss_range_step": -0.01,

|

||||

"minimum_winrate": 0.60,

|

||||

"minimum_expectancy": 0.20,

|

||||

"min_trade_number": 10,

|

||||

"max_trade_duration_minute": 1440,

|

||||

"remove_pumps": false

|

||||

},

|

||||

"telegram": {

|

||||

"enabled": false,

|

||||

"token": "your_telegram_token",

|

||||

"chat_id": "your_telegram_chat_id"

|

||||

},

|

||||

"api_server": {

|

||||

"enabled": false,

|

||||

"listen_ip_address": "127.0.0.1",

|

||||

"listen_port": 8080,

|

||||

"verbosity": "error",

|

||||

"jwt_secret_key": "somethingrandom",

|

||||

"CORS_origins": [],

|

||||

"username": "freqtrader",

|

||||

"password": "SuperSecurePassword"

|

||||

},

|

||||

"bot_name": "freqtrade",

|

||||

"initial_state": "running",

|

||||

"forcebuy_enable": false,

|

||||

"internals": {

|

||||

"process_throttle_secs": 5

|

||||

}

|

||||

}

|

||||

|

|

@ -5,7 +5,6 @@

|

|||

"tradable_balance_ratio": 0.99,

|

||||

"fiat_display_currency": "USD",

|

||||

"amount_reserve_percent": 0.05,

|

||||

"available_capital": 1000,

|

||||

"amend_last_stake_amount": false,

|

||||

"last_stake_amount_min_ratio": 0.5,

|

||||

"dry_run": true,

|

||||

|

|

@ -16,13 +15,11 @@

|

|||

"trailing_stop_positive": 0.005,

|

||||

"trailing_stop_positive_offset": 0.0051,

|

||||

"trailing_only_offset_is_reached": false,

|

||||

"use_exit_signal": true,

|

||||

"exit_profit_only": false,

|

||||

"exit_profit_offset": 0.0,

|

||||

"ignore_roi_if_entry_signal": false,

|

||||

"use_sell_signal": true,

|

||||

"sell_profit_only": false,

|

||||

"sell_profit_offset": 0.0,

|

||||

"ignore_roi_if_buy_signal": false,

|

||||