Compare commits

No commits in common. "develop" and "2021.6" have entirely different histories.

|

|

@ -1,24 +1,13 @@

|

|||

{

|

||||

"name": "freqtrade Develop",

|

||||

"build": {

|

||||

"dockerfile": "Dockerfile",

|

||||

"context": ".."

|

||||

},

|

||||

// Use 'forwardPorts' to make a list of ports inside the container available locally.

|

||||

"forwardPorts": [

|

||||

8080

|

||||

],

|

||||

"mounts": [

|

||||

"source=freqtrade-bashhistory,target=/home/ftuser/commandhistory,type=volume"

|

||||

],

|

||||

"workspaceMount": "source=${localWorkspaceFolder},target=/workspaces/freqtrade,type=bind,consistency=cached",

|

||||

// Uncomment to connect as a non-root user if you've added one. See https://aka.ms/vscode-remote/containers/non-root.

|

||||

"remoteUser": "ftuser",

|

||||

|

||||

"onCreateCommand": "pip install --user -e .",

|

||||

"postCreateCommand": "freqtrade create-userdir --userdir user_data/",

|

||||

"dockerComposeFile": [

|

||||

"docker-compose.yml"

|

||||

],

|

||||

|

||||

"workspaceFolder": "/workspaces/freqtrade",

|

||||

"service": "ft_vscode",

|

||||

|

||||

"workspaceFolder": "/freqtrade/",

|

||||

|

||||

"settings": {

|

||||

"terminal.integrated.shell.linux": "/bin/bash",

|

||||

|

|

@ -36,6 +25,20 @@

|

|||

"ms-python.vscode-pylance",

|

||||

"davidanson.vscode-markdownlint",

|

||||

"ms-azuretools.vscode-docker",

|

||||

"vscode-icons-team.vscode-icons",

|

||||

],

|

||||

|

||||

// Use 'forwardPorts' to make a list of ports inside the container available locally.

|

||||

// "forwardPorts": [],

|

||||

|

||||

// Uncomment the next line if you want start specific services in your Docker Compose config.

|

||||

// "runServices": [],

|

||||

|

||||

// Uncomment the next line if you want to keep your containers running after VS Code shuts down.

|

||||

// "shutdownAction": "none",

|

||||

|

||||

// Uncomment the next line to run commands after the container is created - for example installing curl.

|

||||

// "postCreateCommand": "sudo apt-get update && apt-get install -y git",

|

||||

|

||||

// Uncomment to connect as a non-root user if you've added one. See https://aka.ms/vscode-remote/containers/non-root.

|

||||

"remoteUser": "ftuser"

|

||||

}

|

||||

|

|

|

|||

|

|

@ -0,0 +1,24 @@

|

|||

---

|

||||

version: '3'

|

||||

services:

|

||||

ft_vscode:

|

||||

build:

|

||||

context: ..

|

||||

dockerfile: ".devcontainer/Dockerfile"

|

||||

volumes:

|

||||

# Allow git usage within container

|

||||

- "${HOME}/.ssh:/home/ftuser/.ssh:ro"

|

||||

- "${HOME}/.gitconfig:/home/ftuser/.gitconfig:ro"

|

||||

- ..:/freqtrade:cached

|

||||

# Persist bash-history

|

||||

- freqtrade-vscode-server:/home/ftuser/.vscode-server

|

||||

- freqtrade-bashhistory:/home/ftuser/commandhistory

|

||||

# Expose API port

|

||||

ports:

|

||||

- "127.0.0.1:8080:8080"

|

||||

command: /bin/sh -c "while sleep 1000; do :; done"

|

||||

|

||||

|

||||

volumes:

|

||||

freqtrade-vscode-server:

|

||||

freqtrade-bashhistory:

|

||||

|

|

@ -1,3 +0,0 @@

|

|||

# These are supported funding model platforms

|

||||

|

||||

github: [xmatthias]

|

||||

|

|

@ -9,7 +9,7 @@ assignees: ''

|

|||

<!--

|

||||

Have you searched for similar issues before posting it?

|

||||

|

||||

If you have discovered a bug in the bot, please [search the issue tracker](https://github.com/freqtrade/freqtrade/issues?q=is%3Aissue).

|

||||

If you have discovered a bug in the bot, please [search our issue tracker](https://github.com/freqtrade/freqtrade/issues?q=is%3Aissue).

|

||||

If it hasn't been reported, please create a new issue.

|

||||

|

||||

Please do not use bug reports to request new features.

|

||||

|

|

@ -20,7 +20,7 @@ Please do not use bug reports to request new features.

|

|||

* Operating system: ____

|

||||

* Python Version: _____ (`python -V`)

|

||||

* CCXT version: _____ (`pip freeze | grep ccxt`)

|

||||

* Freqtrade Version: ____ (`freqtrade -V` or `docker compose run --rm freqtrade -V` for Freqtrade running in docker)

|

||||

* Freqtrade Version: ____ (`freqtrade -V` or `docker-compose run --rm freqtrade -V` for Freqtrade running in docker)

|

||||

|

||||

Note: All issues other than enhancement requests will be closed without further comment if the above template is deleted or not filled out.

|

||||

|

||||

|

|

|

|||

|

|

@ -18,9 +18,10 @@ Have you search for this feature before requesting it? It's highly likely that a

|

|||

* Operating system: ____

|

||||

* Python Version: _____ (`python -V`)

|

||||

* CCXT version: _____ (`pip freeze | grep ccxt`)

|

||||

* Freqtrade Version: ____ (`freqtrade -V` or `docker compose run --rm freqtrade -V` for Freqtrade running in docker)

|

||||

* Freqtrade Version: ____ (`freqtrade -V` or `docker-compose run --rm freqtrade -V` for Freqtrade running in docker)

|

||||

|

||||

|

||||

## Describe the enhancement

|

||||

|

||||

*Explain the enhancement you would like*

|

||||

|

||||

|

|

|

|||

|

|

@ -18,8 +18,8 @@ Please do not use the question template to report bugs or to request new feature

|

|||

* Operating system: ____

|

||||

* Python Version: _____ (`python -V`)

|

||||

* CCXT version: _____ (`pip freeze | grep ccxt`)

|

||||

* Freqtrade Version: ____ (`freqtrade -V` or `docker compose run --rm freqtrade -V` for Freqtrade running in docker)

|

||||

* Freqtrade Version: ____ (`freqtrade -V` or `docker-compose run --rm freqtrade -V` for Freqtrade running in docker)

|

||||

|

||||

## Your question

|

||||

|

||||

*Ask the question you have not been able to find an answer in the [Documentation](https://www.freqtrade.io/en/latest/)*

|

||||

*Ask the question you have not been able to find an answer in our [Documentation](https://www.freqtrade.io/en/latest/)*

|

||||

|

|

|

|||

|

|

@ -1,17 +1,15 @@

|

|||

<!-- Thank you for sending your pull request. But first, have you included

|

||||

Thank you for sending your pull request. But first, have you included

|

||||

unit tests, and is your code PEP8 conformant? [More details](https://github.com/freqtrade/freqtrade/blob/develop/CONTRIBUTING.md)

|

||||

-->

|

||||

## Summary

|

||||

|

||||

<!-- Explain in one sentence the goal of this PR -->

|

||||

## Summary

|

||||

Explain in one sentence the goal of this PR

|

||||

|

||||

Solve the issue: #___

|

||||

|

||||

## Quick changelog

|

||||

|

||||

- <change log 1>

|

||||

- <change log 1>

|

||||

- <change log #1>

|

||||

- <change log #2>

|

||||

|

||||

## What's new?

|

||||

|

||||

<!-- Explain in details what this PR solve or improve. You can include visuals. -->

|

||||

*Explain in details what this PR solve or improve. You can include visuals.*

|

||||

|

|

|

|||

|

|

@ -5,17 +5,9 @@ updates:

|

|||

schedule:

|

||||

interval: daily

|

||||

open-pull-requests-limit: 10

|

||||

|

||||

- package-ecosystem: pip

|

||||

directory: "/"

|

||||

schedule:

|

||||

interval: weekly

|

||||

open-pull-requests-limit: 10

|

||||

target-branch: develop

|

||||

|

||||

- package-ecosystem: "github-actions"

|

||||

directory: "/"

|

||||

schedule:

|

||||

interval: "weekly"

|

||||

open-pull-requests-limit: 10

|

||||

target-branch: develop

|

||||

|

|

|

|||

|

|

@ -3,9 +3,9 @@ name: Freqtrade CI

|

|||

on:

|

||||

push:

|

||||

branches:

|

||||

- master

|

||||

- stable

|

||||

- develop

|

||||

- ci/*

|

||||

tags:

|

||||

release:

|

||||

types: [published]

|

||||

|

|

@ -13,38 +13,33 @@ on:

|

|||

schedule:

|

||||

- cron: '0 5 * * 4'

|

||||

|

||||

concurrency:

|

||||

group: ${{ github.workflow }}-${{ github.ref }}

|

||||

cancel-in-progress: true

|

||||

permissions:

|

||||

repository-projects: read

|

||||

jobs:

|

||||

build_linux:

|

||||

|

||||

runs-on: ${{ matrix.os }}

|

||||

strategy:

|

||||

matrix:

|

||||

os: [ ubuntu-20.04, ubuntu-22.04 ]

|

||||

python-version: ["3.8", "3.9", "3.10", "3.11"]

|

||||

os: [ ubuntu-18.04, ubuntu-20.04 ]

|

||||

python-version: [3.7, 3.8, 3.9]

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

- uses: actions/checkout@v2

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

uses: actions/setup-python@v2

|

||||

with:

|

||||

python-version: ${{ matrix.python-version }}

|

||||

|

||||

- name: Cache_dependencies

|

||||

uses: actions/cache@v3

|

||||

uses: actions/cache@v2

|

||||

id: cache

|

||||

with:

|

||||

path: ~/dependencies/

|

||||

key: ${{ runner.os }}-dependencies

|

||||

|

||||

- name: pip cache (linux)

|

||||

uses: actions/cache@v3

|

||||

if: runner.os == 'Linux'

|

||||

uses: actions/cache@v2

|

||||

if: startsWith(matrix.os, 'ubuntu')

|

||||

with:

|

||||

path: ~/.cache/pip

|

||||

key: test-${{ matrix.os }}-${{ matrix.python-version }}-pip

|

||||

|

|

@ -55,9 +50,107 @@ jobs:

|

|||

cd build_helpers && ./install_ta-lib.sh ${HOME}/dependencies/; cd ..

|

||||

|

||||

- name: Installation - *nix

|

||||

if: runner.os == 'Linux'

|

||||

run: |

|

||||

python -m pip install --upgrade pip wheel

|

||||

python -m pip install --upgrade pip

|

||||

export LD_LIBRARY_PATH=${HOME}/dependencies/lib:$LD_LIBRARY_PATH

|

||||

export TA_LIBRARY_PATH=${HOME}/dependencies/lib

|

||||

export TA_INCLUDE_PATH=${HOME}/dependencies/include

|

||||

pip install -r requirements-dev.txt

|

||||

pip install -e .

|

||||

|

||||

- name: Tests

|

||||

run: |

|

||||

pytest --random-order --cov=freqtrade --cov-config=.coveragerc

|

||||

if: matrix.python-version != '3.9'

|

||||

|

||||

- name: Tests incl. ccxt compatibility tests

|

||||

run: |

|

||||

pytest --random-order --cov=freqtrade --cov-config=.coveragerc --longrun

|

||||

if: matrix.python-version == '3.9'

|

||||

|

||||

- name: Coveralls

|

||||

if: (startsWith(matrix.os, 'ubuntu-20') && matrix.python-version == '3.8')

|

||||

env:

|

||||

# Coveralls token. Not used as secret due to github not providing secrets to forked repositories

|

||||

COVERALLS_REPO_TOKEN: 6D1m0xupS3FgutfuGao8keFf9Hc0FpIXu

|

||||

run: |

|

||||

# Allow failure for coveralls

|

||||

coveralls || true

|

||||

|

||||

- name: Backtesting

|

||||

run: |

|

||||

cp config_bittrex.json.example config.json

|

||||

freqtrade create-userdir --userdir user_data

|

||||

freqtrade backtesting --datadir tests/testdata --strategy SampleStrategy

|

||||

|

||||

- name: Hyperopt

|

||||

run: |

|

||||

cp config_bittrex.json.example config.json

|

||||

freqtrade create-userdir --userdir user_data

|

||||

freqtrade hyperopt --datadir tests/testdata -e 5 --strategy SampleStrategy --hyperopt SampleHyperOpt --hyperopt-loss SharpeHyperOptLossDaily --print-all

|

||||

|

||||

- name: Flake8

|

||||

run: |

|

||||

flake8

|

||||

|

||||

- name: Sort imports (isort)

|

||||

run: |

|

||||

isort --check .

|

||||

|

||||

- name: Mypy

|

||||

run: |

|

||||

mypy freqtrade scripts

|

||||

|

||||

- name: Slack Notification

|

||||

uses: lazy-actions/slatify@v3.0.0

|

||||

if: failure() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

type: ${{ job.status }}

|

||||

job_name: '*Freqtrade CI ${{ matrix.os }}*'

|

||||

mention: 'here'

|

||||

mention_if: 'failure'

|

||||

channel: '#notifications'

|

||||

url: ${{ secrets.SLACK_WEBHOOK }}

|

||||

|

||||

build_macos:

|

||||

runs-on: ${{ matrix.os }}

|

||||

strategy:

|

||||

matrix:

|

||||

os: [ macos-latest ]

|

||||

python-version: [3.7, 3.8, 3.9]

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v2

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v2

|

||||

with:

|

||||

python-version: ${{ matrix.python-version }}

|

||||

|

||||

- name: Cache_dependencies

|

||||

uses: actions/cache@v2

|

||||

id: cache

|

||||

with:

|

||||

path: ~/dependencies/

|

||||

key: ${{ runner.os }}-dependencies

|

||||

|

||||

- name: pip cache (macOS)

|

||||

uses: actions/cache@v2

|

||||

if: startsWith(matrix.os, 'macOS')

|

||||

with:

|

||||

path: ~/Library/Caches/pip

|

||||

key: test-${{ matrix.os }}-${{ matrix.python-version }}-pip

|

||||

|

||||

- name: TA binary *nix

|

||||

if: steps.cache.outputs.cache-hit != 'true'

|

||||

run: |

|

||||

cd build_helpers && ./install_ta-lib.sh ${HOME}/dependencies/; cd ..

|

||||

|

||||

- name: Installation - macOS

|

||||

run: |

|

||||

brew update

|

||||

brew install hdf5 c-blosc

|

||||

python -m pip install --upgrade pip

|

||||

export LD_LIBRARY_PATH=${HOME}/dependencies/lib:$LD_LIBRARY_PATH

|

||||

export TA_LIBRARY_PATH=${HOME}/dependencies/lib

|

||||

export TA_INCLUDE_PATH=${HOME}/dependencies/include

|

||||

|

|

@ -69,143 +162,49 @@ jobs:

|

|||

pytest --random-order --cov=freqtrade --cov-config=.coveragerc

|

||||

|

||||

- name: Coveralls

|

||||

if: (runner.os == 'Linux' && matrix.python-version == '3.10' && matrix.os == 'ubuntu-22.04')

|

||||

if: (startsWith(matrix.os, 'ubuntu-20') && matrix.python-version == '3.8')

|

||||

env:

|

||||

# Coveralls token. Not used as secret due to github not providing secrets to forked repositories

|

||||

COVERALLS_REPO_TOKEN: 6D1m0xupS3FgutfuGao8keFf9Hc0FpIXu

|

||||

run: |

|

||||

# Allow failure for coveralls

|

||||

coveralls || true

|

||||

|

||||

- name: Backtesting (multi)

|

||||

run: |

|

||||

cp config_examples/config_bittrex.example.json config.json

|

||||

freqtrade create-userdir --userdir user_data

|

||||

freqtrade new-strategy -s AwesomeStrategy

|

||||

freqtrade new-strategy -s AwesomeStrategyMin --template minimal

|

||||

freqtrade backtesting --datadir tests/testdata --strategy-list AwesomeStrategy AwesomeStrategyMin -i 5m

|

||||

|

||||

- name: Hyperopt

|

||||

run: |

|

||||

cp config_examples/config_bittrex.example.json config.json

|

||||

freqtrade create-userdir --userdir user_data

|

||||

freqtrade hyperopt --datadir tests/testdata -e 6 --strategy SampleStrategy --hyperopt-loss SharpeHyperOptLossDaily --print-all

|

||||

|

||||

- name: Sort imports (isort)

|

||||

run: |

|

||||

isort --check .

|

||||

|

||||

- name: Run Ruff

|

||||

run: |

|

||||

ruff check --format=github .

|

||||

|

||||

- name: Mypy

|

||||

run: |

|

||||

mypy freqtrade scripts tests

|

||||

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

if: failure() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

severity: error

|

||||

details: Freqtrade CI failed on ${{ matrix.os }}

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

|

||||

build_macos:

|

||||

runs-on: ${{ matrix.os }}

|

||||

strategy:

|

||||

matrix:

|

||||

os: [ macos-latest ]

|

||||

python-version: ["3.8", "3.9", "3.10", "3.11"]

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

with:

|

||||

python-version: ${{ matrix.python-version }}

|

||||

|

||||

- name: Cache_dependencies

|

||||

uses: actions/cache@v3

|

||||

id: cache

|

||||

with:

|

||||

path: ~/dependencies/

|

||||

key: ${{ runner.os }}-dependencies

|

||||

|

||||

- name: pip cache (macOS)

|

||||

uses: actions/cache@v3

|

||||

if: runner.os == 'macOS'

|

||||

with:

|

||||

path: ~/Library/Caches/pip

|

||||

key: test-${{ matrix.os }}-${{ matrix.python-version }}-pip

|

||||

|

||||

- name: TA binary *nix

|

||||

if: steps.cache.outputs.cache-hit != 'true'

|

||||

run: |

|

||||

cd build_helpers && ./install_ta-lib.sh ${HOME}/dependencies/; cd ..

|

||||

|

||||

- name: Installation - macOS

|

||||

if: runner.os == 'macOS'

|

||||

run: |

|

||||

brew update

|

||||

# homebrew fails to update python due to unlinking failures

|

||||

# https://github.com/actions/runner-images/issues/6817

|

||||

rm /usr/local/bin/2to3 || true

|

||||

rm /usr/local/bin/2to3-3.11 || true

|

||||

rm /usr/local/bin/idle3 || true

|

||||

rm /usr/local/bin/idle3.11 || true

|

||||

rm /usr/local/bin/pydoc3 || true

|

||||

rm /usr/local/bin/pydoc3.11 || true

|

||||

rm /usr/local/bin/python3 || true

|

||||

rm /usr/local/bin/python3.11 || true

|

||||

rm /usr/local/bin/python3-config || true

|

||||

rm /usr/local/bin/python3.11-config || true

|

||||

|

||||

brew install hdf5 c-blosc

|

||||

python -m pip install --upgrade pip wheel

|

||||

export LD_LIBRARY_PATH=${HOME}/dependencies/lib:$LD_LIBRARY_PATH

|

||||

export TA_LIBRARY_PATH=${HOME}/dependencies/lib

|

||||

export TA_INCLUDE_PATH=${HOME}/dependencies/include

|

||||

pip install -r requirements-dev.txt

|

||||

pip install -e .

|

||||

|

||||

- name: Tests

|

||||

run: |

|

||||

pytest --random-order

|

||||

coveralls -v || true

|

||||

|

||||

- name: Backtesting

|

||||

run: |

|

||||

cp config_examples/config_bittrex.example.json config.json

|

||||

cp config_bittrex.json.example config.json

|

||||

freqtrade create-userdir --userdir user_data

|

||||

freqtrade new-strategy -s AwesomeStrategyAdv --template advanced

|

||||

freqtrade backtesting --datadir tests/testdata --strategy AwesomeStrategyAdv

|

||||

freqtrade backtesting --datadir tests/testdata --strategy SampleStrategy

|

||||

|

||||

- name: Hyperopt

|

||||

run: |

|

||||

cp config_examples/config_bittrex.example.json config.json

|

||||

cp config_bittrex.json.example config.json

|

||||

freqtrade create-userdir --userdir user_data

|

||||

freqtrade hyperopt --datadir tests/testdata -e 5 --strategy SampleStrategy --hyperopt-loss SharpeHyperOptLossDaily --print-all

|

||||

freqtrade hyperopt --datadir tests/testdata -e 5 --strategy SampleStrategy --hyperopt SampleHyperOpt --hyperopt-loss SharpeHyperOptLossDaily --print-all

|

||||

|

||||

- name: Flake8

|

||||

run: |

|

||||

flake8

|

||||

|

||||

- name: Sort imports (isort)

|

||||

run: |

|

||||

isort --check .

|

||||

|

||||

- name: Run Ruff

|

||||

run: |

|

||||

ruff check --format=github .

|

||||

|

||||

- name: Mypy

|

||||

run: |

|

||||

mypy freqtrade scripts

|

||||

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

- name: Slack Notification

|

||||

uses: lazy-actions/slatify@v3.0.0

|

||||

if: failure() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

severity: info

|

||||

details: Test Succeeded!

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

type: ${{ job.status }}

|

||||

job_name: '*Freqtrade CI ${{ matrix.os }}*'

|

||||

mention: 'here'

|

||||

mention_if: 'failure'

|

||||

channel: '#notifications'

|

||||

url: ${{ secrets.SLACK_WEBHOOK }}

|

||||

|

||||

|

||||

build_windows:

|

||||

|

||||

|

|

@ -213,18 +212,19 @@ jobs:

|

|||

strategy:

|

||||

matrix:

|

||||

os: [ windows-latest ]

|

||||

python-version: ["3.8", "3.9", "3.10", "3.11"]

|

||||

python-version: [3.7, 3.8]

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

- uses: actions/checkout@v2

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

uses: actions/setup-python@v2

|

||||

with:

|

||||

python-version: ${{ matrix.python-version }}

|

||||

|

||||

- name: Pip cache (Windows)

|

||||

uses: actions/cache@v3

|

||||

uses: actions/cache@preview

|

||||

if: startsWith(runner.os, 'Windows')

|

||||

with:

|

||||

path: ~\AppData\Local\pip\Cache

|

||||

key: ${{ matrix.os }}-${{ matrix.python-version }}-pip

|

||||

|

|

@ -235,74 +235,52 @@ jobs:

|

|||

|

||||

- name: Tests

|

||||

run: |

|

||||

pytest --random-order

|

||||

pytest --random-order --cov=freqtrade --cov-config=.coveragerc

|

||||

|

||||

- name: Backtesting

|

||||

run: |

|

||||

cp config_examples/config_bittrex.example.json config.json

|

||||

cp config_bittrex.json.example config.json

|

||||

freqtrade create-userdir --userdir user_data

|

||||

freqtrade backtesting --datadir tests/testdata --strategy SampleStrategy

|

||||

|

||||

- name: Hyperopt

|

||||

run: |

|

||||

cp config_examples/config_bittrex.example.json config.json

|

||||

cp config_bittrex.json.example config.json

|

||||

freqtrade create-userdir --userdir user_data

|

||||

freqtrade hyperopt --datadir tests/testdata -e 5 --strategy SampleStrategy --hyperopt-loss SharpeHyperOptLossDaily --print-all

|

||||

freqtrade hyperopt --datadir tests/testdata -e 5 --strategy SampleStrategy --hyperopt SampleHyperOpt --hyperopt-loss SharpeHyperOptLossDaily --print-all

|

||||

|

||||

- name: Run Ruff

|

||||

- name: Flake8

|

||||

run: |

|

||||

ruff check --format=github .

|

||||

flake8

|

||||

|

||||

- name: Mypy

|

||||

run: |

|

||||

mypy freqtrade scripts tests

|

||||

mypy freqtrade scripts

|

||||

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

- name: Slack Notification

|

||||

uses: lazy-actions/slatify@v3.0.0

|

||||

if: failure() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

severity: error

|

||||

details: Test Failed

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

|

||||

mypy_version_check:

|

||||

runs-on: ubuntu-22.04

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

with:

|

||||

python-version: "3.10"

|

||||

|

||||

- name: pre-commit dependencies

|

||||

run: |

|

||||

pip install pyaml

|

||||

python build_helpers/pre_commit_update.py

|

||||

|

||||

pre-commit:

|

||||

runs-on: ubuntu-22.04

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- uses: actions/setup-python@v4

|

||||

with:

|

||||

python-version: "3.10"

|

||||

- uses: pre-commit/action@v3.0.0

|

||||

type: ${{ job.status }}

|

||||

job_name: '*Freqtrade CI windows*'

|

||||

mention: 'here'

|

||||

mention_if: 'failure'

|

||||

channel: '#notifications'

|

||||

url: ${{ secrets.SLACK_WEBHOOK }}

|

||||

|

||||

docs_check:

|

||||

runs-on: ubuntu-22.04

|

||||

runs-on: ubuntu-20.04

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

- uses: actions/checkout@v2

|

||||

|

||||

- name: Documentation syntax

|

||||

run: |

|

||||

./tests/test_docs.sh

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

uses: actions/setup-python@v2

|

||||

with:

|

||||

python-version: "3.10"

|

||||

python-version: 3.8

|

||||

|

||||

- name: Documentation build

|

||||

run: |

|

||||

|

|

@ -310,78 +288,28 @@ jobs:

|

|||

pip install mkdocs

|

||||

mkdocs build

|

||||

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

- name: Slack Notification

|

||||

uses: lazy-actions/slatify@v3.0.0

|

||||

if: failure() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

severity: error

|

||||

details: Freqtrade doc test failed!

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

type: ${{ job.status }}

|

||||

job_name: '*Freqtrade Docs*'

|

||||

channel: '#notifications'

|

||||

url: ${{ secrets.SLACK_WEBHOOK }}

|

||||

|

||||

|

||||

build_linux_online:

|

||||

# Run pytest with "live" checks

|

||||

runs-on: ubuntu-22.04

|

||||

cleanup-prior-runs:

|

||||

runs-on: ubuntu-20.04

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

with:

|

||||

python-version: "3.9"

|

||||

|

||||

- name: Cache_dependencies

|

||||

uses: actions/cache@v3

|

||||

id: cache

|

||||

with:

|

||||

path: ~/dependencies/

|

||||

key: ${{ runner.os }}-dependencies

|

||||

|

||||

- name: pip cache (linux)

|

||||

uses: actions/cache@v3

|

||||

if: runner.os == 'Linux'

|

||||

with:

|

||||

path: ~/.cache/pip

|

||||

key: test-${{ matrix.os }}-${{ matrix.python-version }}-pip

|

||||

|

||||

- name: TA binary *nix

|

||||

if: steps.cache.outputs.cache-hit != 'true'

|

||||

run: |

|

||||

cd build_helpers && ./install_ta-lib.sh ${HOME}/dependencies/; cd ..

|

||||

|

||||

- name: Installation - *nix

|

||||

if: runner.os == 'Linux'

|

||||

run: |

|

||||

python -m pip install --upgrade pip wheel

|

||||

export LD_LIBRARY_PATH=${HOME}/dependencies/lib:$LD_LIBRARY_PATH

|

||||

export TA_LIBRARY_PATH=${HOME}/dependencies/lib

|

||||

export TA_INCLUDE_PATH=${HOME}/dependencies/include

|

||||

pip install -r requirements-dev.txt

|

||||

pip install -e .

|

||||

|

||||

- name: Tests incl. ccxt compatibility tests

|

||||

- name: Cleanup previous runs on this branch

|

||||

uses: rokroskar/workflow-run-cleanup-action@v0.3.3

|

||||

if: "!startsWith(github.ref, 'refs/tags/') && github.ref != 'refs/heads/stable' && github.repository == 'freqtrade/freqtrade'"

|

||||

env:

|

||||

CI_WEB_PROXY: http://152.67.78.211:13128

|

||||

run: |

|

||||

pytest --random-order --cov=freqtrade --cov-config=.coveragerc --longrun

|

||||

GITHUB_TOKEN: "${{ secrets.GITHUB_TOKEN }}"

|

||||

|

||||

|

||||

# Notify only once - when CI completes (and after deploy) in case it's successfull

|

||||

# Notify on slack only once - when CI completes (and after deploy) in case it's successfull

|

||||

notify-complete:

|

||||

needs: [

|

||||

build_linux,

|

||||

build_macos,

|

||||

build_windows,

|

||||

docs_check,

|

||||

mypy_version_check,

|

||||

pre-commit,

|

||||

build_linux_online

|

||||

]

|

||||

runs-on: ubuntu-22.04

|

||||

# Discord notification can't handle schedule events

|

||||

if: (github.event_name != 'schedule')

|

||||

permissions:

|

||||

repository-projects: read

|

||||

needs: [ build_linux, build_macos, build_windows, docs_check ]

|

||||

runs-on: ubuntu-20.04

|

||||

steps:

|

||||

|

||||

- name: Check user permission

|

||||

|

|

@ -392,27 +320,27 @@ jobs:

|

|||

env:

|

||||

GITHUB_TOKEN: ${{ secrets.GITHUB_TOKEN }}

|

||||

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

- name: Slack Notification

|

||||

uses: lazy-actions/slatify@v3.0.0

|

||||

if: always() && steps.check.outputs.has-permission && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

severity: info

|

||||

details: Test Completed!

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

type: ${{ job.status }}

|

||||

job_name: '*Freqtrade CI*'

|

||||

channel: '#notifications'

|

||||

url: ${{ secrets.SLACK_WEBHOOK }}

|

||||

|

||||

deploy:

|

||||

needs: [ build_linux, build_macos, build_windows, docs_check, mypy_version_check, pre-commit ]

|

||||

runs-on: ubuntu-22.04

|

||||

needs: [ build_linux, build_macos, build_windows, docs_check ]

|

||||

runs-on: ubuntu-20.04

|

||||

|

||||

if: (github.event_name == 'push' || github.event_name == 'schedule' || github.event_name == 'release') && github.repository == 'freqtrade/freqtrade'

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

- uses: actions/checkout@v2

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v4

|

||||

uses: actions/setup-python@v2

|

||||

with:

|

||||

python-version: "3.9"

|

||||

python-version: 3.8

|

||||

|

||||

- name: Extract branch name

|

||||

shell: bash

|

||||

|

|

@ -425,7 +353,7 @@ jobs:

|

|||

python setup.py sdist bdist_wheel

|

||||

|

||||

- name: Publish to PyPI (Test)

|

||||

uses: pypa/gh-action-pypi-publish@v1.8.5

|

||||

uses: pypa/gh-action-pypi-publish@master

|

||||

if: (github.event_name == 'release')

|

||||

with:

|

||||

user: __token__

|

||||

|

|

@ -433,7 +361,7 @@ jobs:

|

|||

repository_url: https://test.pypi.org/legacy/

|

||||

|

||||

- name: Publish to PyPI

|

||||

uses: pypa/gh-action-pypi-publish@v1.8.5

|

||||

uses: pypa/gh-action-pypi-publish@master

|

||||

if: (github.event_name == 'release')

|

||||

with:

|

||||

user: __token__

|

||||

|

|

@ -456,7 +384,7 @@ jobs:

|

|||

|

||||

- name: Set up Docker Buildx

|

||||

id: buildx

|

||||

uses: crazy-max/ghaction-docker-buildx@v3.3.1

|

||||

uses: crazy-max/ghaction-docker-buildx@v1

|

||||

with:

|

||||

buildx-version: latest

|

||||

qemu-version: latest

|

||||

|

|

@ -466,45 +394,20 @@ jobs:

|

|||

|

||||

- name: Build and test and push docker images

|

||||

env:

|

||||

IMAGE_NAME: freqtradeorg/freqtrade

|

||||

BRANCH_NAME: ${{ steps.extract_branch.outputs.branch }}

|

||||

run: |

|

||||

build_helpers/publish_docker_multi.sh

|

||||

|

||||

deploy_arm:

|

||||

permissions:

|

||||

packages: write

|

||||

needs: [ deploy ]

|

||||

# Only run on 64bit machines

|

||||

runs-on: [self-hosted, linux, ARM64]

|

||||

if: (github.event_name == 'push' || github.event_name == 'schedule' || github.event_name == 'release') && github.repository == 'freqtrade/freqtrade'

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- name: Extract branch name

|

||||

shell: bash

|

||||

run: echo "##[set-output name=branch;]$(echo ${GITHUB_REF##*/})"

|

||||

id: extract_branch

|

||||

|

||||

- name: Dockerhub login

|

||||

env:

|

||||

DOCKER_PASSWORD: ${{ secrets.DOCKER_PASSWORD }}

|

||||

DOCKER_USERNAME: ${{ secrets.DOCKER_USERNAME }}

|

||||

run: |

|

||||

echo "${DOCKER_PASSWORD}" | docker login --username ${DOCKER_USERNAME} --password-stdin

|

||||

|

||||

- name: Build and test and push docker images

|

||||

env:

|

||||

BRANCH_NAME: ${{ steps.extract_branch.outputs.branch }}

|

||||

GHCR_USERNAME: ${{ github.actor }}

|

||||

GHCR_TOKEN: ${{ secrets.GITHUB_TOKEN }}

|

||||

run: |

|

||||

build_helpers/publish_docker_arm64.sh

|

||||

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

if: always() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false) && (github.event_name != 'schedule')

|

||||

- name: Slack Notification

|

||||

uses: lazy-actions/slatify@v3.0.0

|

||||

if: always() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

severity: info

|

||||

details: Deploy Succeeded!

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

type: ${{ job.status }}

|

||||

job_name: '*Freqtrade CI Deploy*'

|

||||

mention: 'here'

|

||||

mention_if: 'failure'

|

||||

channel: '#notifications'

|

||||

url: ${{ secrets.SLACK_WEBHOOK }}

|

||||

|

||||

|

|

|

|||

|

|

@ -8,10 +8,11 @@ jobs:

|

|||

dockerHubDescription:

|

||||

runs-on: ubuntu-latest

|

||||

steps:

|

||||

- uses: actions/checkout@v3

|

||||

- uses: actions/checkout@v1

|

||||

- name: Docker Hub Description

|

||||

uses: peter-evans/dockerhub-description@v3

|

||||

uses: peter-evans/dockerhub-description@v2.1.0

|

||||

env:

|

||||

DOCKERHUB_USERNAME: ${{ secrets.DOCKER_USERNAME }}

|

||||

DOCKERHUB_PASSWORD: ${{ secrets.DOCKER_PASSWORD }}

|

||||

DOCKERHUB_REPOSITORY: freqtradeorg/freqtrade

|

||||

|

||||

|

|

|

|||

|

|

@ -1,24 +1,14 @@

|

|||

# Freqtrade rules

|

||||

config*.json

|

||||

*.sqlite

|

||||

*.sqlite-shm

|

||||

*.sqlite-wal

|

||||

logfile.txt

|

||||

user_data/*

|

||||

!user_data/strategy/sample_strategy.py

|

||||

!user_data/notebooks

|

||||

!user_data/models

|

||||

!user_data/freqaimodels

|

||||

user_data/freqaimodels/*

|

||||

user_data/models/*

|

||||

user_data/notebooks/*

|

||||

freqtrade-plot.html

|

||||

freqtrade-profit-plot.html

|

||||

freqtrade/rpc/api_server/ui/*

|

||||

build_helpers/ta-lib/*

|

||||

|

||||

# Macos related

|

||||

.DS_Store

|

||||

|

||||

# Byte-compiled / optimized / DLL files

|

||||

__pycache__/

|

||||

|

|

@ -85,8 +75,6 @@ instance/

|

|||

|

||||

# Sphinx documentation

|

||||

docs/_build/

|

||||

# Mkdocs documentation

|

||||

site/

|

||||

|

||||

# PyBuilder

|

||||

target/

|

||||

|

|

@ -107,8 +95,3 @@ target/

|

|||

|

||||

#exceptions

|

||||

!*.gitkeep

|

||||

!config_examples/config_binance.example.json

|

||||

!config_examples/config_bittrex.example.json

|

||||

!config_examples/config_full.example.json

|

||||

!config_examples/config_kraken.example.json

|

||||

!config_examples/config_freqai.example.json

|

||||

|

|

|

|||

|

|

@ -1,55 +0,0 @@

|

|||

# See https://pre-commit.com for more information

|

||||

# See https://pre-commit.com/hooks.html for more hooks

|

||||

repos:

|

||||

- repo: https://github.com/pycqa/flake8

|

||||

rev: "6.0.0"

|

||||

hooks:

|

||||

- id: flake8

|

||||

# stages: [push]

|

||||

|

||||

- repo: https://github.com/pre-commit/mirrors-mypy

|

||||

rev: "v1.0.1"

|

||||

hooks:

|

||||

- id: mypy

|

||||

exclude: build_helpers

|

||||

additional_dependencies:

|

||||

- types-cachetools==5.3.0.5

|

||||

- types-filelock==3.2.7

|

||||

- types-requests==2.28.11.17

|

||||

- types-tabulate==0.9.0.2

|

||||

- types-python-dateutil==2.8.19.12

|

||||

- SQLAlchemy==2.0.9

|

||||

# stages: [push]

|

||||

|

||||

- repo: https://github.com/pycqa/isort

|

||||

rev: "5.12.0"

|

||||

hooks:

|

||||

- id: isort

|

||||

name: isort (python)

|

||||

# stages: [push]

|

||||

|

||||

- repo: https://github.com/charliermarsh/ruff-pre-commit

|

||||

# Ruff version.

|

||||

rev: 'v0.0.255'

|

||||

hooks:

|

||||

- id: ruff

|

||||

|

||||

- repo: https://github.com/pre-commit/pre-commit-hooks

|

||||

rev: v4.4.0

|

||||

hooks:

|

||||

- id: end-of-file-fixer

|

||||

exclude: |

|

||||

(?x)^(

|

||||

tests/.*|

|

||||

.*\.svg|

|

||||

.*\.yml|

|

||||

.*\.json

|

||||

)$

|

||||

- id: mixed-line-ending

|

||||

- id: debug-statements

|

||||

- id: check-ast

|

||||

- id: trailing-whitespace

|

||||

exclude: |

|

||||

(?x)^(

|

||||

.*\.md

|

||||

)$

|

||||

|

|

@ -7,3 +7,4 @@ ignore=vendor

|

|||

|

||||

[TYPECHECK]

|

||||

ignored-modules=numpy,talib,talib.abstract

|

||||

|

||||

|

|

|

|||

|

|

@ -0,0 +1,55 @@

|

|||

os:

|

||||

- linux

|

||||

dist: bionic

|

||||

language: python

|

||||

python:

|

||||

- 3.8

|

||||

services:

|

||||

- docker

|

||||

env:

|

||||

global:

|

||||

- IMAGE_NAME=freqtradeorg/freqtrade

|

||||

install:

|

||||

- cd build_helpers && ./install_ta-lib.sh ${HOME}/dependencies; cd ..

|

||||

- export LD_LIBRARY_PATH=${HOME}/dependencies/lib:$LD_LIBRARY_PATH

|

||||

- export TA_LIBRARY_PATH=${HOME}/dependencies/lib

|

||||

- export TA_INCLUDE_PATH=${HOME}/dependencies/include

|

||||

- pip install -r requirements-dev.txt

|

||||

- pip install -e .

|

||||

jobs:

|

||||

|

||||

include:

|

||||

- stage: tests

|

||||

script:

|

||||

- pytest --random-order --cov=freqtrade --cov-config=.coveragerc

|

||||

# Allow failure for coveralls

|

||||

# - coveralls || true

|

||||

name: pytest

|

||||

- script:

|

||||

- cp config_bittrex.json.example config.json

|

||||

- freqtrade create-userdir --userdir user_data

|

||||

- freqtrade backtesting --datadir tests/testdata --strategy SampleStrategy

|

||||

name: backtest

|

||||

- script:

|

||||

- cp config_bittrex.json.example config.json

|

||||

- freqtrade create-userdir --userdir user_data

|

||||

- freqtrade hyperopt --datadir tests/testdata -e 5 --strategy SampleStrategy --hyperopt SampleHyperOpt --hyperopt-loss SharpeHyperOptLossDaily

|

||||

name: hyperopt

|

||||

- script: flake8

|

||||

name: flake8

|

||||

- script:

|

||||

# Test Documentation boxes -

|

||||

# !!! <TYPE>: is not allowed!

|

||||

# !!! <TYPE> "title" - Title needs to be quoted!

|

||||

- grep -Er '^!{3}\s\S+:|^!{3}\s\S+\s[^"]' docs/*; test $? -ne 0

|

||||

name: doc syntax

|

||||

- script: mypy freqtrade scripts

|

||||

name: mypy

|

||||

|

||||

notifications:

|

||||

slack:

|

||||

secure: bKLXmOrx8e2aPZl7W8DA5BdPAXWGpI5UzST33oc1G/thegXcDVmHBTJrBs4sZak6bgAclQQrdZIsRd2eFYzHLalJEaw6pk7hoAw8SvLnZO0ZurWboz7qg2+aZZXfK4eKl/VUe4sM9M4e/qxjkK+yWG7Marg69c4v1ypF7ezUi1fPYILYw8u0paaiX0N5UX8XNlXy+PBlga2MxDjUY70MuajSZhPsY2pDUvYnMY1D/7XN3cFW0g+3O8zXjF0IF4q1Z/1ASQe+eYjKwPQacE+O8KDD+ZJYoTOFBAPllrtpO1jnOPFjNGf3JIbVMZw4bFjIL0mSQaiSUaUErbU3sFZ5Or79rF93XZ81V7uEZ55vD8KMfR2CB1cQJcZcj0v50BxLo0InkFqa0Y8Nra3sbpV4fV5Oe8pDmomPJrNFJnX6ULQhQ1gTCe0M5beKgVms5SITEpt4/Y0CmLUr6iHDT0CUiyMIRWAXdIgbGh1jfaWOMksybeRevlgDsIsNBjXmYI1Sw2ZZR2Eo2u4R6zyfyjOMLwYJ3vgq9IrACv2w5nmf0+oguMWHf6iWi2hiOqhlAN1W74+3HsYQcqnuM3LGOmuCnPprV1oGBqkPXjIFGpy21gNx4vHfO1noLUyJnMnlu2L7SSuN1CdLsnjJ1hVjpJjPfqB4nn8g12x87TqM1bOm+3Q=

|

||||

cache:

|

||||

pip: True

|

||||

directories:

|

||||

- $HOME/dependencies

|

||||

|

|

@ -12,7 +12,7 @@ Few pointers for contributions:

|

|||

- New features need to contain unit tests, must conform to PEP8 (max-line-length = 100) and should be documented with the introduction PR.

|

||||

- PR's can be declared as `[WIP]` - which signify Work in Progress Pull Requests (which are not finished).

|

||||

|

||||

If you are unsure, discuss the feature on our [discord server](https://discord.gg/p7nuUNVfP7) or in a [issue](https://github.com/freqtrade/freqtrade/issues) before a Pull Request.

|

||||

If you are unsure, discuss the feature on our [discord server](https://discord.gg/p7nuUNVfP7), on [Slack](https://join.slack.com/t/highfrequencybot/shared_invite/zt-mm786y93-Fxo37glxMY9g8OQC5AoOIw) or in a [issue](https://github.com/freqtrade/freqtrade/issues) before a PR.

|

||||

|

||||

## Getting started

|

||||

|

||||

|

|

@ -45,24 +45,16 @@ pytest tests/test_<file_name>.py::test_<method_name>

|

|||

|

||||

### 2. Test if your code is PEP8 compliant

|

||||

|

||||

#### Run Ruff

|

||||

#### Run Flake8

|

||||

|

||||

```bash

|

||||

ruff .

|

||||

flake8 freqtrade tests scripts

|

||||

```

|

||||

|

||||

We receive a lot of code that fails the `ruff` checks.

|

||||

We receive a lot of code that fails the `flake8` checks.

|

||||

To help with that, we encourage you to install the git pre-commit

|

||||

hook that will warn you when you try to commit code that fails these checks.

|

||||

|

||||

you can manually run pre-commit with `pre-commit run -a`.

|

||||

|

||||

##### Additional styles applied

|

||||

|

||||

* Have docstrings on all public methods

|

||||

* Use double-quotes for docstrings

|

||||

* Multiline docstrings should be indented to the level of the first quote

|

||||

* Doc-strings should follow the reST format (`:param xxx: ...`, `:return: ...`, `:raises KeyError: ... `)

|

||||

hook that will warn you when you try to commit code that fails these checks.

|

||||

Guide for installing them is [here](http://flake8.pycqa.org/en/latest/user/using-hooks.html).

|

||||

|

||||

### 3. Test if all type-hints are correct

|

||||

|

||||

|

|

|

|||

|

|

@ -1,4 +1,4 @@

|

|||

FROM python:3.10.11-slim-bullseye as base

|

||||

FROM python:3.9.5-slim-buster as base

|

||||

|

||||

# Setup env

|

||||

ENV LANG C.UTF-8

|

||||

|

|

@ -11,9 +11,9 @@ ENV FT_APP_ENV="docker"

|

|||

# Prepare environment

|

||||

RUN mkdir /freqtrade \

|

||||

&& apt-get update \

|

||||

&& apt-get -y install sudo libatlas3-base curl sqlite3 libhdf5-serial-dev libgomp1 \

|

||||

&& apt-get -y install sudo libatlas3-base curl sqlite3 libhdf5-serial-dev \

|

||||

&& apt-get clean \

|

||||

&& useradd -u 1000 -G sudo -U -m -s /bin/bash ftuser \

|

||||

&& useradd -u 1000 -G sudo -U -m ftuser \

|

||||

&& chown ftuser:ftuser /freqtrade \

|

||||

# Allow sudoers

|

||||

&& echo "ftuser ALL=(ALL) NOPASSWD: /bin/chown" >> /etc/sudoers

|

||||

|

|

|

|||

|

|

@ -2,6 +2,5 @@ include LICENSE

|

|||

include README.md

|

||||

recursive-include freqtrade *.py

|

||||

recursive-include freqtrade/templates/ *.j2 *.ipynb

|

||||

include freqtrade/exchange/binance_leverage_tiers.json

|

||||

include freqtrade/rpc/api_server/ui/fallback_file.html

|

||||

include freqtrade/rpc/api_server/ui/favicon.ico

|

||||

|

|

|

|||

83

README.md

|

|

@ -1,12 +1,11 @@

|

|||

#

|

||||

|

||||

[](https://github.com/freqtrade/freqtrade/actions/)

|

||||

[](https://doi.org/10.21105/joss.04864)

|

||||

[](https://coveralls.io/github/freqtrade/freqtrade?branch=develop)

|

||||

[](https://www.freqtrade.io)

|

||||

[](https://codeclimate.com/github/freqtrade/freqtrade/maintainability)

|

||||

|

||||

Freqtrade is a free and open source crypto trading bot written in Python. It is designed to support all major exchanges and be controlled via Telegram or webUI. It contains backtesting, plotting and money management tools as well as strategy optimization by machine learning.

|

||||

Freqtrade is a free and open source crypto trading bot written in Python. It is designed to support all major exchanges and be controlled via Telegram. It contains backtesting, plotting and money management tools as well as strategy optimization by machine learning.

|

||||

|

||||

|

||||

|

||||

|

|

@ -27,57 +26,50 @@ hesitate to read the source code and understand the mechanism of this bot.

|

|||

|

||||

Please read the [exchange specific notes](docs/exchanges.md) to learn about eventual, special configurations needed for each exchange.

|

||||

|

||||

- [X] [Binance](https://www.binance.com/)

|

||||

- [X] [Bittrex](https://bittrex.com/)

|

||||

- [X] [Gate.io](https://www.gate.io/ref/6266643)

|

||||

- [X] [Huobi](http://huobi.com/)

|

||||

- [X] [Binance](https://www.binance.com/) ([*Note for binance users](docs/exchanges.md#blacklists))

|

||||

- [X] [Kraken](https://kraken.com/)

|

||||

- [X] [OKX](https://okx.com/) (Former OKEX)

|

||||

- [X] [FTX](https://ftx.com)

|

||||

- [ ] [potentially many others](https://github.com/ccxt/ccxt/). _(We cannot guarantee they will work)_

|

||||

|

||||

### Supported Futures Exchanges (experimental)

|

||||

|

||||

- [X] [Binance](https://www.binance.com/)

|

||||

- [X] [Gate.io](https://www.gate.io/ref/6266643)

|

||||

- [X] [OKX](https://okx.com/)

|

||||

- [X] [Bybit](https://bybit.com/)

|

||||

|

||||

Please make sure to read the [exchange specific notes](docs/exchanges.md), as well as the [trading with leverage](docs/leverage.md) documentation before diving in.

|

||||

|

||||

### Community tested

|

||||

|

||||

Exchanges confirmed working by the community:

|

||||

|

||||

- [X] [Bitvavo](https://bitvavo.com/)

|

||||

- [X] [Kucoin](https://www.kucoin.com/)

|

||||

|

||||

## Documentation

|

||||

|

||||

We invite you to read the bot documentation to ensure you understand how the bot is working.

|

||||

|

||||

Please find the complete documentation on the [freqtrade website](https://www.freqtrade.io).

|

||||

Please find the complete documentation on our [website](https://www.freqtrade.io).

|

||||

|

||||

## Features

|

||||

|

||||

- [x] **Based on Python 3.8+**: For botting on any operating system - Windows, macOS and Linux.

|

||||

- [x] **Based on Python 3.7+**: For botting on any operating system - Windows, macOS and Linux.

|

||||

- [x] **Persistence**: Persistence is achieved through sqlite.

|

||||

- [x] **Dry-run**: Run the bot without paying money.

|

||||

- [x] **Backtesting**: Run a simulation of your buy/sell strategy.

|

||||

- [x] **Strategy Optimization by machine learning**: Use machine learning to optimize your buy/sell strategy parameters with real exchange data.

|

||||

- [X] **Adaptive prediction modeling**: Build a smart strategy with FreqAI that self-trains to the market via adaptive machine learning methods. [Learn more](https://www.freqtrade.io/en/stable/freqai/)

|

||||

- [x] **Edge position sizing** Calculate your win rate, risk reward ratio, the best stoploss and adjust your position size before taking a position for each specific market. [Learn more](https://www.freqtrade.io/en/stable/edge/).

|

||||

- [x] **Edge position sizing** Calculate your win rate, risk reward ratio, the best stoploss and adjust your position size before taking a position for each specific market. [Learn more](https://www.freqtrade.io/en/latest/edge/).

|

||||

- [x] **Whitelist crypto-currencies**: Select which crypto-currency you want to trade or use dynamic whitelists.

|

||||

- [x] **Blacklist crypto-currencies**: Select which crypto-currency you want to avoid.

|

||||

- [x] **Builtin WebUI**: Builtin web UI to manage your bot.

|

||||

- [x] **Manageable via Telegram**: Manage the bot with Telegram.

|

||||

- [x] **Display profit/loss in fiat**: Display your profit/loss in fiat currency.

|

||||

- [x] **Display profit/loss in fiat**: Display your profit/loss in 33 fiat.

|

||||

- [x] **Daily summary of profit/loss**: Provide a daily summary of your profit/loss.

|

||||

- [x] **Performance status report**: Provide a performance status of your current trades.

|

||||

|

||||

## Quick start

|

||||

|

||||

Please refer to the [Docker Quickstart documentation](https://www.freqtrade.io/en/stable/docker_quickstart/) on how to get started quickly.

|

||||

Freqtrade provides a Linux/macOS script to install all dependencies and help you to configure the bot.

|

||||

|

||||

For further (native) installation methods, please refer to the [Installation documentation page](https://www.freqtrade.io/en/stable/installation/).

|

||||

```bash

|

||||

git clone -b develop https://github.com/freqtrade/freqtrade.git

|

||||

cd freqtrade

|

||||

./setup.sh --install

|

||||

```

|

||||

|

||||

For any other type of installation please refer to [Installation doc](https://www.freqtrade.io/en/latest/installation/).

|

||||

|

||||

## Basic Usage

|

||||

|

||||

|

|

@ -85,22 +77,22 @@ For further (native) installation methods, please refer to the [Installation doc

|

|||

|

||||

```

|

||||

usage: freqtrade [-h] [-V]

|

||||

{trade,create-userdir,new-config,new-strategy,download-data,convert-data,convert-trade-data,list-data,backtesting,edge,hyperopt,hyperopt-list,hyperopt-show,list-exchanges,list-hyperopts,list-markets,list-pairs,list-strategies,list-timeframes,show-trades,test-pairlist,install-ui,plot-dataframe,plot-profit,webserver}

|

||||

{trade,create-userdir,new-config,new-hyperopt,new-strategy,download-data,convert-data,convert-trade-data,backtesting,edge,hyperopt,hyperopt-list,hyperopt-show,list-exchanges,list-hyperopts,list-markets,list-pairs,list-strategies,list-timeframes,show-trades,test-pairlist,plot-dataframe,plot-profit}

|

||||

...

|

||||

|

||||

Free, open source crypto trading bot

|

||||

|

||||

positional arguments:

|

||||

{trade,create-userdir,new-config,new-strategy,download-data,convert-data,convert-trade-data,list-data,backtesting,edge,hyperopt,hyperopt-list,hyperopt-show,list-exchanges,list-hyperopts,list-markets,list-pairs,list-strategies,list-timeframes,show-trades,test-pairlist,install-ui,plot-dataframe,plot-profit,webserver}

|

||||

{trade,create-userdir,new-config,new-hyperopt,new-strategy,download-data,convert-data,convert-trade-data,backtesting,edge,hyperopt,hyperopt-list,hyperopt-show,list-exchanges,list-hyperopts,list-markets,list-pairs,list-strategies,list-timeframes,show-trades,test-pairlist,plot-dataframe,plot-profit}

|

||||

trade Trade module.

|

||||

create-userdir Create user-data directory.

|

||||

new-config Create new config

|

||||

new-hyperopt Create new hyperopt

|

||||

new-strategy Create new strategy

|

||||

download-data Download backtesting data.

|

||||

convert-data Convert candle (OHLCV) data from one format to

|

||||

another.

|

||||

convert-trade-data Convert trade data from one format to another.

|

||||

list-data List downloaded data.

|

||||

backtesting Backtesting module.

|

||||

edge Edge module.

|

||||

hyperopt Hyperopt module.

|

||||

|

|

@ -114,10 +106,8 @@ positional arguments:

|

|||

list-timeframes Print available timeframes for the exchange.

|

||||

show-trades Show trades.

|

||||

test-pairlist Test your pairlist configuration.

|

||||

install-ui Install FreqUI

|

||||

plot-dataframe Plot candles with indicators.

|

||||

plot-profit Generate plot showing profits.

|

||||

webserver Webserver module.

|

||||

|

||||

optional arguments:

|

||||

-h, --help show this help message and exit

|

||||

|

|

@ -127,15 +117,14 @@ optional arguments:

|

|||

|

||||

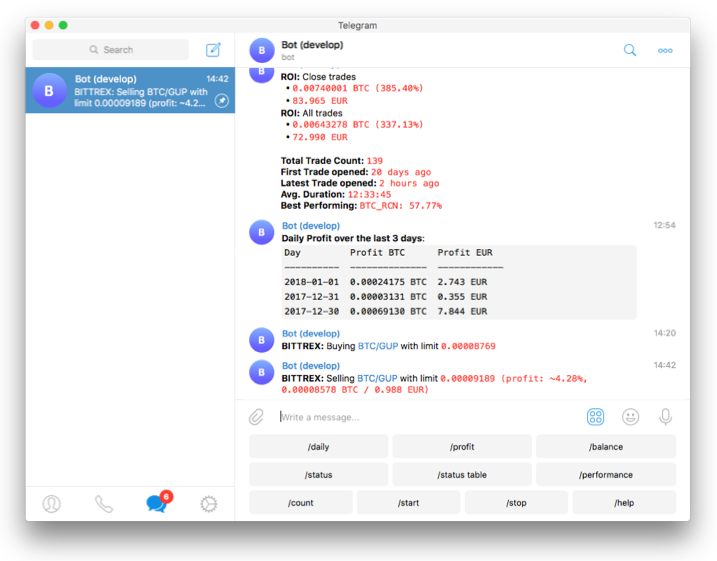

### Telegram RPC commands

|

||||

|

||||

Telegram is not mandatory. However, this is a great way to control your bot. More details and the full command list on the [documentation](https://www.freqtrade.io/en/latest/telegram-usage/)

|

||||

Telegram is not mandatory. However, this is a great way to control your bot. More details and the full command list on our [documentation](https://www.freqtrade.io/en/latest/telegram-usage/)

|

||||

|

||||

- `/start`: Starts the trader.

|

||||

- `/stop`: Stops the trader.

|

||||

- `/stopentry`: Stop entering new trades.

|

||||

- `/stopbuy`: Stop entering new trades.

|

||||

- `/status <trade_id>|[table]`: Lists all or specific open trades.

|

||||

- `/profit [<n>]`: Lists cumulative profit from all finished trades, over the last n days.

|

||||

- `/forceexit <trade_id>|all`: Instantly exits the given trade (Ignoring `minimum_roi`).

|

||||

- `/fx <trade_id>|all`: Alias to `/forceexit`

|

||||

- `/forcesell <trade_id>|all`: Instantly sells the given trade (Ignoring `minimum_roi`).

|

||||

- `/performance`: Show performance of each finished trade grouped by pair

|

||||

- `/balance`: Show account balance per currency.

|

||||

- `/daily <n>`: Shows profit or loss per day, over the last n days.

|

||||

|

|

@ -152,23 +141,23 @@ The project is currently setup in two main branches:

|

|||

|

||||

## Support

|

||||

|

||||

### Help / Discord

|

||||

### Help / Discord / Slack

|

||||

|

||||

For any questions not covered by the documentation or for further information about the bot, or to simply engage with like-minded individuals, we encourage you to join the Freqtrade [discord server](https://discord.gg/p7nuUNVfP7).

|

||||

For any questions not covered by the documentation or for further information about the bot, or to simply engage with like-minded individuals, we encourage you to join our slack channel.

|

||||

|

||||

Please check out our [discord server](https://discord.gg/p7nuUNVfP7).

|

||||

|

||||

You can also join our [Slack channel](https://join.slack.com/t/highfrequencybot/shared_invite/zt-mm786y93-Fxo37glxMY9g8OQC5AoOIw).

|

||||

|

||||

### [Bugs / Issues](https://github.com/freqtrade/freqtrade/issues?q=is%3Aissue)

|

||||

|

||||

If you discover a bug in the bot, please

|

||||

[search the issue tracker](https://github.com/freqtrade/freqtrade/issues?q=is%3Aissue)

|

||||

[search our issue tracker](https://github.com/freqtrade/freqtrade/issues?q=is%3Aissue)

|

||||

first. If it hasn't been reported, please

|

||||

[create a new issue](https://github.com/freqtrade/freqtrade/issues/new/choose) and

|

||||

ensure you follow the template guide so that the team can assist you as

|

||||

ensure you follow the template guide so that our team can assist you as

|

||||

quickly as possible.

|

||||

|

||||

For every [issue](https://github.com/freqtrade/freqtrade/issues/new/choose) created, kindly follow up and mark satisfaction or reminder to close issue when equilibrium ground is reached.

|

||||

|

||||

--Maintain github's [community policy](https://docs.github.com/en/site-policy/github-terms/github-community-code-of-conduct)--

|

||||

|

||||

### [Feature Requests](https://github.com/freqtrade/freqtrade/labels/enhancement)

|

||||

|

||||

Have you a great idea to improve the bot you want to share? Please,

|

||||

|

|

@ -180,16 +169,16 @@ in the bug reports.

|

|||

|

||||

### [Pull Requests](https://github.com/freqtrade/freqtrade/pulls)

|

||||

|

||||

Feel like the bot is missing a feature? We welcome your pull requests!

|

||||

Feel like our bot is missing a feature? We welcome your pull requests!

|

||||

|

||||

Please read the

|

||||

Please read our

|

||||

[Contributing document](https://github.com/freqtrade/freqtrade/blob/develop/CONTRIBUTING.md)

|

||||

to understand the requirements before sending your pull-requests.

|

||||

|

||||

Coding is not a necessity to contribute - maybe start with improving the documentation?

|

||||

Coding is not a necessity to contribute - maybe start with improving our documentation?

|

||||

Issues labeled [good first issue](https://github.com/freqtrade/freqtrade/labels/good%20first%20issue) can be good first contributions, and will help get you familiar with the codebase.

|

||||

|

||||

**Note** before starting any major new feature work, *please open an issue describing what you are planning to do* or talk to us on [discord](https://discord.gg/p7nuUNVfP7) (please use the #dev channel for this). This will ensure that interested parties can give valuable feedback on the feature, and let others know that you are working on it.

|

||||

**Note** before starting any major new feature work, *please open an issue describing what you are planning to do* or talk to us on [discord](https://discord.gg/p7nuUNVfP7) or [Slack](https://join.slack.com/t/highfrequencybot/shared_invite/zt-mm786y93-Fxo37glxMY9g8OQC5AoOIw). This will ensure that interested parties can give valuable feedback on the feature, and let others know that you are working on it.

|

||||

|

||||

**Important:** Always create your PR against the `develop` branch, not `stable`.

|

||||

|

||||

|

|

@ -199,7 +188,7 @@ Issues labeled [good first issue](https://github.com/freqtrade/freqtrade/labels/

|

|||

|

||||

The clock must be accurate, synchronized to a NTP server very frequently to avoid problems with communication to the exchanges.

|

||||

|

||||

### Minimum hardware required

|

||||

### Min hardware required

|

||||

|

||||

To run this bot we recommend you a cloud instance with a minimum of:

|

||||

|

||||

|

|

@ -207,7 +196,7 @@ To run this bot we recommend you a cloud instance with a minimum of:

|

|||

|

||||

### Software requirements

|

||||

|

||||

- [Python >= 3.8](http://docs.python-guide.org/en/latest/starting/installation/)

|

||||

- [Python 3.7.x](http://docs.python-guide.org/en/latest/starting/installation/)

|

||||

- [pip](https://pip.pypa.io/en/stable/installing/)

|

||||

- [git](https://git-scm.com/book/en/v2/Getting-Started-Installing-Git)

|

||||

- [TA-Lib](https://mrjbq7.github.io/ta-lib/install.html)

|

||||

|

|

|

|||

|

|

@ -4,31 +4,17 @@ else

|

|||

INSTALL_LOC=${1}

|

||||

fi

|

||||

echo "Installing to ${INSTALL_LOC}"

|

||||

if [ -n "$2" ] || [ ! -f "${INSTALL_LOC}/lib/libta_lib.a" ]; then

|

||||

if [ ! -f "${INSTALL_LOC}/lib/libta_lib.a" ]; then

|

||||

tar zxvf ta-lib-0.4.0-src.tar.gz

|

||||

cd ta-lib \

|

||||

&& sed -i.bak "s|0.00000001|0.000000000000000001 |g" src/ta_func/ta_utility.h \

|

||||

&& curl 'https://raw.githubusercontent.com/gcc-mirror/gcc/master/config.guess' -o config.guess \

|

||||

&& curl 'https://raw.githubusercontent.com/gcc-mirror/gcc/master/config.sub' -o config.sub \

|

||||

&& curl 'http://git.savannah.gnu.org/gitweb/?p=config.git;a=blob_plain;f=config.guess;hb=HEAD' -o config.guess \

|

||||

&& curl 'http://git.savannah.gnu.org/gitweb/?p=config.git;a=blob_plain;f=config.sub;hb=HEAD' -o config.sub \

|

||||

&& ./configure --prefix=${INSTALL_LOC}/ \

|

||||

&& make

|

||||

if [ $? -ne 0 ]; then

|

||||

echo "Failed building ta-lib."

|

||||

cd .. && rm -rf ./ta-lib/

|

||||

exit 1

|

||||

fi

|

||||

if [ -z "$2" ]; then

|

||||

which sudo && sudo make install || make install

|

||||

if [ -x "$(command -v apt-get)" ]; then

|

||||

echo "Updating library path using ldconfig"

|

||||

sudo ldconfig

|

||||

fi

|

||||

else

|

||||

# Don't install with sudo

|

||||

make install

|

||||

fi

|

||||

|

||||

cd .. && rm -rf ./ta-lib/

|

||||

&& make -j$(nproc) \

|

||||

&& which sudo && sudo make install || make install \

|

||||

&& cd ..

|

||||

else

|

||||

echo "TA-lib already installed, skipping installation"

|

||||

fi

|

||||

# && sed -i.bak "s|0.00000001|0.000000000000000001 |g" src/ta_func/ta_utility.h \

|

||||

|

|

|

|||

|

|

@ -1,21 +1,16 @@

|

|||