Merge branch 'develop' into v3_fixes

This commit is contained in:

3

.github/FUNDING.yml

vendored

Normal file

3

.github/FUNDING.yml

vendored

Normal file

@@ -0,0 +1,3 @@

|

||||

# These are supported funding model platforms

|

||||

|

||||

github: [xmatthias]

|

||||

2

.github/ISSUE_TEMPLATE/bug_report.md

vendored

2

.github/ISSUE_TEMPLATE/bug_report.md

vendored

@@ -9,7 +9,7 @@ assignees: ''

|

||||

<!--

|

||||

Have you searched for similar issues before posting it?

|

||||

|

||||

If you have discovered a bug in the bot, please [search our issue tracker](https://github.com/freqtrade/freqtrade/issues?q=is%3Aissue).

|

||||

If you have discovered a bug in the bot, please [search the issue tracker](https://github.com/freqtrade/freqtrade/issues?q=is%3Aissue).

|

||||

If it hasn't been reported, please create a new issue.

|

||||

|

||||

Please do not use bug reports to request new features.

|

||||

|

||||

2

.github/ISSUE_TEMPLATE/question.md

vendored

2

.github/ISSUE_TEMPLATE/question.md

vendored

@@ -22,4 +22,4 @@ Please do not use the question template to report bugs or to request new feature

|

||||

|

||||

## Your question

|

||||

|

||||

*Ask the question you have not been able to find an answer in our [Documentation](https://www.freqtrade.io/en/latest/)*

|

||||

*Ask the question you have not been able to find an answer in the [Documentation](https://www.freqtrade.io/en/latest/)*

|

||||

|

||||

8

.github/dependabot.yml

vendored

8

.github/dependabot.yml

vendored

@@ -5,9 +5,17 @@ updates:

|

||||

schedule:

|

||||

interval: daily

|

||||

open-pull-requests-limit: 10

|

||||

|

||||

- package-ecosystem: pip

|

||||

directory: "/"

|

||||

schedule:

|

||||

interval: weekly

|

||||

open-pull-requests-limit: 10

|

||||

target-branch: develop

|

||||

|

||||

- package-ecosystem: "github-actions"

|

||||

directory: "/"

|

||||

schedule:

|

||||

interval: "weekly"

|

||||

open-pull-requests-limit: 10

|

||||

target-branch: develop

|

||||

|

||||

135

.github/workflows/ci.yml

vendored

135

.github/workflows/ci.yml

vendored

@@ -3,9 +3,9 @@ name: Freqtrade CI

|

||||

on:

|

||||

push:

|

||||

branches:

|

||||

- master

|

||||

- stable

|

||||

- develop

|

||||

- ci/*

|

||||

tags:

|

||||

release:

|

||||

types: [published]

|

||||

@@ -20,26 +20,26 @@ jobs:

|

||||

strategy:

|

||||

matrix:

|

||||

os: [ ubuntu-18.04, ubuntu-20.04 ]

|

||||

python-version: [3.7, 3.8, 3.9]

|

||||

python-version: ["3.8", "3.9", "3.10"]

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v2

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v2

|

||||

uses: actions/setup-python@v3

|

||||

with:

|

||||

python-version: ${{ matrix.python-version }}

|

||||

|

||||

- name: Cache_dependencies

|

||||

uses: actions/cache@v2

|

||||

uses: actions/cache@v3

|

||||

id: cache

|

||||

with:

|

||||

path: ~/dependencies/

|

||||

key: ${{ runner.os }}-dependencies

|

||||

|

||||

- name: pip cache (linux)

|

||||

uses: actions/cache@v2

|

||||

if: startsWith(matrix.os, 'ubuntu')

|

||||

uses: actions/cache@v3

|

||||

if: runner.os == 'Linux'

|

||||

with:

|

||||

path: ~/.cache/pip

|

||||

key: test-${{ matrix.os }}-${{ matrix.python-version }}-pip

|

||||

@@ -50,8 +50,9 @@ jobs:

|

||||

cd build_helpers && ./install_ta-lib.sh ${HOME}/dependencies/; cd ..

|

||||

|

||||

- name: Installation - *nix

|

||||

if: runner.os == 'Linux'

|

||||

run: |

|

||||

python -m pip install --upgrade pip

|

||||

python -m pip install --upgrade pip wheel

|

||||

export LD_LIBRARY_PATH=${HOME}/dependencies/lib:$LD_LIBRARY_PATH

|

||||

export TA_LIBRARY_PATH=${HOME}/dependencies/lib

|

||||

export TA_INCLUDE_PATH=${HOME}/dependencies/include

|

||||

@@ -69,7 +70,7 @@ jobs:

|

||||

if: matrix.python-version == '3.9'

|

||||

|

||||

- name: Coveralls

|

||||

if: (startsWith(matrix.os, 'ubuntu-20') && matrix.python-version == '3.8')

|

||||

if: (runner.os == 'Linux' && matrix.python-version == '3.8')

|

||||

env:

|

||||

# Coveralls token. Not used as secret due to github not providing secrets to forked repositories

|

||||

COVERALLS_REPO_TOKEN: 6D1m0xupS3FgutfuGao8keFf9Hc0FpIXu

|

||||

@@ -101,42 +102,39 @@ jobs:

|

||||

run: |

|

||||

mypy freqtrade scripts

|

||||

|

||||

- name: Slack Notification

|

||||

uses: lazy-actions/slatify@v3.0.0

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

if: failure() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

type: ${{ job.status }}

|

||||

job_name: '*Freqtrade CI ${{ matrix.os }}*'

|

||||

mention: 'here'

|

||||

mention_if: 'failure'

|

||||

channel: '#notifications'

|

||||

url: ${{ secrets.SLACK_WEBHOOK }}

|

||||

severity: error

|

||||

details: Freqtrade CI failed on ${{ matrix.os }}

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

|

||||

build_macos:

|

||||

runs-on: ${{ matrix.os }}

|

||||

strategy:

|

||||

matrix:

|

||||

os: [ macos-latest ]

|

||||

python-version: [3.7, 3.8, 3.9]

|

||||

python-version: ["3.8", "3.9", "3.10"]

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v2

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v2

|

||||

uses: actions/setup-python@v3

|

||||

with:

|

||||

python-version: ${{ matrix.python-version }}

|

||||

|

||||

- name: Cache_dependencies

|

||||

uses: actions/cache@v2

|

||||

uses: actions/cache@v3

|

||||

id: cache

|

||||

with:

|

||||

path: ~/dependencies/

|

||||

key: ${{ runner.os }}-dependencies

|

||||

|

||||

- name: pip cache (macOS)

|

||||

uses: actions/cache@v2

|

||||

if: startsWith(matrix.os, 'macOS')

|

||||

uses: actions/cache@v3

|

||||

if: runner.os == 'macOS'

|

||||

with:

|

||||

path: ~/Library/Caches/pip

|

||||

key: test-${{ matrix.os }}-${{ matrix.python-version }}-pip

|

||||

@@ -147,10 +145,11 @@ jobs:

|

||||

cd build_helpers && ./install_ta-lib.sh ${HOME}/dependencies/; cd ..

|

||||

|

||||

- name: Installation - macOS

|

||||

if: runner.os == 'macOS'

|

||||

run: |

|

||||

brew update

|

||||

brew install hdf5 c-blosc

|

||||

python -m pip install --upgrade pip

|

||||

python -m pip install --upgrade pip wheel

|

||||

export LD_LIBRARY_PATH=${HOME}/dependencies/lib:$LD_LIBRARY_PATH

|

||||

export TA_LIBRARY_PATH=${HOME}/dependencies/lib

|

||||

export TA_INCLUDE_PATH=${HOME}/dependencies/include

|

||||

@@ -162,7 +161,7 @@ jobs:

|

||||

pytest --random-order --cov=freqtrade --cov-config=.coveragerc

|

||||

|

||||

- name: Coveralls

|

||||

if: (startsWith(matrix.os, 'ubuntu-20') && matrix.python-version == '3.8')

|

||||

if: (runner.os == 'Linux' && matrix.python-version == '3.8')

|

||||

env:

|

||||

# Coveralls token. Not used as secret due to github not providing secrets to forked repositories

|

||||

COVERALLS_REPO_TOKEN: 6D1m0xupS3FgutfuGao8keFf9Hc0FpIXu

|

||||

@@ -194,17 +193,13 @@ jobs:

|

||||

run: |

|

||||

mypy freqtrade scripts

|

||||

|

||||

- name: Slack Notification

|

||||

uses: lazy-actions/slatify@v3.0.0

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

if: failure() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

type: ${{ job.status }}

|

||||

job_name: '*Freqtrade CI ${{ matrix.os }}*'

|

||||

mention: 'here'

|

||||

mention_if: 'failure'

|

||||

channel: '#notifications'

|

||||

url: ${{ secrets.SLACK_WEBHOOK }}

|

||||

|

||||

severity: info

|

||||

details: Test Succeeded!

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

|

||||

build_windows:

|

||||

|

||||

@@ -212,19 +207,18 @@ jobs:

|

||||

strategy:

|

||||

matrix:

|

||||

os: [ windows-latest ]

|

||||

python-version: [3.7, 3.8]

|

||||

python-version: ["3.8", "3.9", "3.10"]

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v2

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v2

|

||||

uses: actions/setup-python@v3

|

||||

with:

|

||||

python-version: ${{ matrix.python-version }}

|

||||

|

||||

- name: Pip cache (Windows)

|

||||

uses: actions/cache@preview

|

||||

if: startsWith(runner.os, 'Windows')

|

||||

uses: actions/cache@v3

|

||||

with:

|

||||

path: ~\AppData\Local\pip\Cache

|

||||

key: ${{ matrix.os }}-${{ matrix.python-version }}-pip

|

||||

@@ -257,28 +251,25 @@ jobs:

|

||||

run: |

|

||||

mypy freqtrade scripts

|

||||

|

||||

- name: Slack Notification

|

||||

uses: lazy-actions/slatify@v3.0.0

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

if: failure() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

type: ${{ job.status }}

|

||||

job_name: '*Freqtrade CI windows*'

|

||||

mention: 'here'

|

||||

mention_if: 'failure'

|

||||

channel: '#notifications'

|

||||

url: ${{ secrets.SLACK_WEBHOOK }}

|

||||

severity: error

|

||||

details: Test Failed

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

|

||||

docs_check:

|

||||

runs-on: ubuntu-20.04

|

||||

steps:

|

||||

- uses: actions/checkout@v2

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- name: Documentation syntax

|

||||

run: |

|

||||

./tests/test_docs.sh

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v2

|

||||

uses: actions/setup-python@v3

|

||||

with:

|

||||

python-version: 3.8

|

||||

|

||||

@@ -288,14 +279,13 @@ jobs:

|

||||

pip install mkdocs

|

||||

mkdocs build

|

||||

|

||||

- name: Slack Notification

|

||||

uses: lazy-actions/slatify@v3.0.0

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

if: failure() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

type: ${{ job.status }}

|

||||

job_name: '*Freqtrade Docs*'

|

||||

channel: '#notifications'

|

||||

url: ${{ secrets.SLACK_WEBHOOK }}

|

||||

severity: error

|

||||

details: Freqtrade doc test failed!

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

|

||||

cleanup-prior-runs:

|

||||

runs-on: ubuntu-20.04

|

||||

@@ -306,7 +296,7 @@ jobs:

|

||||

env:

|

||||

GITHUB_TOKEN: "${{ secrets.GITHUB_TOKEN }}"

|

||||

|

||||

# Notify on slack only once - when CI completes (and after deploy) in case it's successfull

|

||||

# Notify only once - when CI completes (and after deploy) in case it's successfull

|

||||

notify-complete:

|

||||

needs: [ build_linux, build_macos, build_windows, docs_check ]

|

||||

runs-on: ubuntu-20.04

|

||||

@@ -320,14 +310,13 @@ jobs:

|

||||

env:

|

||||

GITHUB_TOKEN: ${{ secrets.GITHUB_TOKEN }}

|

||||

|

||||

- name: Slack Notification

|

||||

uses: lazy-actions/slatify@v3.0.0

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

if: always() && steps.check.outputs.has-permission && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

type: ${{ job.status }}

|

||||

job_name: '*Freqtrade CI*'

|

||||

channel: '#notifications'

|

||||

url: ${{ secrets.SLACK_WEBHOOK }}

|

||||

severity: info

|

||||

details: Test Completed!

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

|

||||

deploy:

|

||||

needs: [ build_linux, build_macos, build_windows, docs_check ]

|

||||

@@ -336,10 +325,10 @@ jobs:

|

||||

if: (github.event_name == 'push' || github.event_name == 'schedule' || github.event_name == 'release') && github.repository == 'freqtrade/freqtrade'

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v2

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- name: Set up Python

|

||||

uses: actions/setup-python@v2

|

||||

uses: actions/setup-python@v3

|

||||

with:

|

||||

python-version: 3.8

|

||||

|

||||

@@ -385,7 +374,7 @@ jobs:

|

||||

|

||||

- name: Set up Docker Buildx

|

||||

id: buildx

|

||||

uses: crazy-max/ghaction-docker-buildx@v1

|

||||

uses: crazy-max/ghaction-docker-buildx@v3.3.1

|

||||

with:

|

||||

buildx-version: latest

|

||||

qemu-version: latest

|

||||

@@ -400,17 +389,13 @@ jobs:

|

||||

run: |

|

||||

build_helpers/publish_docker_multi.sh

|

||||

|

||||

|

||||

- name: Slack Notification

|

||||

uses: lazy-actions/slatify@v3.0.0

|

||||

- name: Discord notification

|

||||

uses: rjstone/discord-webhook-notify@v1

|

||||

if: always() && ( github.event_name != 'pull_request' || github.event.pull_request.head.repo.fork == false)

|

||||

with:

|

||||

type: ${{ job.status }}

|

||||

job_name: '*Freqtrade CI Deploy*'

|

||||

mention: 'here'

|

||||

mention_if: 'failure'

|

||||

channel: '#notifications'

|

||||

url: ${{ secrets.SLACK_WEBHOOK }}

|

||||

severity: info

|

||||

details: Deploy Succeeded!

|

||||

webhookUrl: ${{ secrets.DISCORD_WEBHOOK }}

|

||||

|

||||

|

||||

deploy_arm:

|

||||

@@ -420,7 +405,7 @@ jobs:

|

||||

if: (github.event_name == 'push' || github.event_name == 'schedule' || github.event_name == 'release') && github.repository == 'freqtrade/freqtrade'

|

||||

|

||||

steps:

|

||||

- uses: actions/checkout@v2

|

||||

- uses: actions/checkout@v3

|

||||

|

||||

- name: Extract branch name

|

||||

shell: bash

|

||||

|

||||

4

.github/workflows/docker_update_readme.yml

vendored

4

.github/workflows/docker_update_readme.yml

vendored

@@ -8,9 +8,9 @@ jobs:

|

||||

dockerHubDescription:

|

||||

runs-on: ubuntu-latest

|

||||

steps:

|

||||

- uses: actions/checkout@v1

|

||||

- uses: actions/checkout@v3

|

||||

- name: Docker Hub Description

|

||||

uses: peter-evans/dockerhub-description@v2.1.0

|

||||

uses: peter-evans/dockerhub-description@v3

|

||||

env:

|

||||

DOCKERHUB_USERNAME: ${{ secrets.DOCKER_USERNAME }}

|

||||

DOCKERHUB_PASSWORD: ${{ secrets.DOCKER_PASSWORD }}

|

||||

|

||||

5

.gitignore

vendored

5

.gitignore

vendored

@@ -1,6 +1,8 @@

|

||||

# Freqtrade rules

|

||||

config*.json

|

||||

*.sqlite

|

||||

*.sqlite-shm

|

||||

*.sqlite-wal

|

||||

logfile.txt

|

||||

user_data/*

|

||||

!user_data/strategy/sample_strategy.py

|

||||

@@ -10,6 +12,9 @@ freqtrade-plot.html

|

||||

freqtrade-profit-plot.html

|

||||

freqtrade/rpc/api_server/ui/*

|

||||

|

||||

# Macos related

|

||||

.DS_Store

|

||||

|

||||

# Byte-compiled / optimized / DLL files

|

||||

__pycache__/

|

||||

*.py[cod]

|

||||

|

||||

21

.pre-commit-config.yaml

Normal file

21

.pre-commit-config.yaml

Normal file

@@ -0,0 +1,21 @@

|

||||

# See https://pre-commit.com for more information

|

||||

# See https://pre-commit.com/hooks.html for more hooks

|

||||

repos:

|

||||

- repo: https://github.com/pycqa/flake8

|

||||

rev: '4.0.1'

|

||||

hooks:

|

||||

- id: flake8

|

||||

# stages: [push]

|

||||

|

||||

- repo: https://github.com/pre-commit/mirrors-mypy

|

||||

rev: 'v0.942'

|

||||

hooks:

|

||||

- id: mypy

|

||||

# stages: [push]

|

||||

|

||||

- repo: https://github.com/pycqa/isort

|

||||

rev: '5.10.1'

|

||||

hooks:

|

||||

- id: isort

|

||||

name: isort (python)

|

||||

# stages: [push]

|

||||

55

.travis.yml

55

.travis.yml

@@ -1,55 +0,0 @@

|

||||

os:

|

||||

- linux

|

||||

dist: bionic

|

||||

language: python

|

||||

python:

|

||||

- 3.8

|

||||

services:

|

||||

- docker

|

||||

env:

|

||||

global:

|

||||

- IMAGE_NAME=freqtradeorg/freqtrade

|

||||

install:

|

||||

- cd build_helpers && ./install_ta-lib.sh ${HOME}/dependencies; cd ..

|

||||

- export LD_LIBRARY_PATH=${HOME}/dependencies/lib:$LD_LIBRARY_PATH

|

||||

- export TA_LIBRARY_PATH=${HOME}/dependencies/lib

|

||||

- export TA_INCLUDE_PATH=${HOME}/dependencies/include

|

||||

- pip install -r requirements-dev.txt

|

||||

- pip install -e .

|

||||

jobs:

|

||||

|

||||

include:

|

||||

- stage: tests

|

||||

script:

|

||||

- pytest --random-order --cov=freqtrade --cov-config=.coveragerc

|

||||

# Allow failure for coveralls

|

||||

# - coveralls || true

|

||||

name: pytest

|

||||

- script:

|

||||

- cp config_examples/config_bittrex.example.json config.json

|

||||

- freqtrade create-userdir --userdir user_data

|

||||

- freqtrade backtesting --datadir tests/testdata --strategy SampleStrategy

|

||||

name: backtest

|

||||

- script:

|

||||

- cp config_examples/config_bittrex.example.json config.json

|

||||

- freqtrade create-userdir --userdir user_data

|

||||

- freqtrade hyperopt --datadir tests/testdata -e 5 --strategy SampleStrategy --hyperopt-loss SharpeHyperOptLossDaily

|

||||

name: hyperopt

|

||||

- script: flake8

|

||||

name: flake8

|

||||

- script:

|

||||

# Test Documentation boxes -

|

||||

# !!! <TYPE>: is not allowed!

|

||||

# !!! <TYPE> "title" - Title needs to be quoted!

|

||||

- grep -Er '^!{3}\s\S+:|^!{3}\s\S+\s[^"]' docs/*; test $? -ne 0

|

||||

name: doc syntax

|

||||

- script: mypy freqtrade scripts

|

||||

name: mypy

|

||||

|

||||

notifications:

|

||||

slack:

|

||||

secure: bKLXmOrx8e2aPZl7W8DA5BdPAXWGpI5UzST33oc1G/thegXcDVmHBTJrBs4sZak6bgAclQQrdZIsRd2eFYzHLalJEaw6pk7hoAw8SvLnZO0ZurWboz7qg2+aZZXfK4eKl/VUe4sM9M4e/qxjkK+yWG7Marg69c4v1ypF7ezUi1fPYILYw8u0paaiX0N5UX8XNlXy+PBlga2MxDjUY70MuajSZhPsY2pDUvYnMY1D/7XN3cFW0g+3O8zXjF0IF4q1Z/1ASQe+eYjKwPQacE+O8KDD+ZJYoTOFBAPllrtpO1jnOPFjNGf3JIbVMZw4bFjIL0mSQaiSUaUErbU3sFZ5Or79rF93XZ81V7uEZ55vD8KMfR2CB1cQJcZcj0v50BxLo0InkFqa0Y8Nra3sbpV4fV5Oe8pDmomPJrNFJnX6ULQhQ1gTCe0M5beKgVms5SITEpt4/Y0CmLUr6iHDT0CUiyMIRWAXdIgbGh1jfaWOMksybeRevlgDsIsNBjXmYI1Sw2ZZR2Eo2u4R6zyfyjOMLwYJ3vgq9IrACv2w5nmf0+oguMWHf6iWi2hiOqhlAN1W74+3HsYQcqnuM3LGOmuCnPprV1oGBqkPXjIFGpy21gNx4vHfO1noLUyJnMnlu2L7SSuN1CdLsnjJ1hVjpJjPfqB4nn8g12x87TqM1bOm+3Q=

|

||||

cache:

|

||||

pip: True

|

||||

directories:

|

||||

- $HOME/dependencies

|

||||

@@ -56,6 +56,13 @@ To help with that, we encourage you to install the git pre-commit

|

||||

hook that will warn you when you try to commit code that fails these checks.

|

||||

Guide for installing them is [here](http://flake8.pycqa.org/en/latest/user/using-hooks.html).

|

||||

|

||||

##### Additional styles applied

|

||||

|

||||

* Have docstrings on all public methods

|

||||

* Use double-quotes for docstrings

|

||||

* Multiline docstrings should be indented to the level of the first quote

|

||||

* Doc-strings should follow the reST format (`:param xxx: ...`, `:return: ...`, `:raises KeyError: ... `)

|

||||

|

||||

### 3. Test if all type-hints are correct

|

||||

|

||||

#### Run mypy

|

||||

|

||||

@@ -1,4 +1,4 @@

|

||||

FROM python:3.9.7-slim-buster as base

|

||||

FROM python:3.9.9-slim-bullseye as base

|

||||

|

||||

# Setup env

|

||||

ENV LANG C.UTF-8

|

||||

|

||||

@@ -2,5 +2,6 @@ include LICENSE

|

||||

include README.md

|

||||

recursive-include freqtrade *.py

|

||||

recursive-include freqtrade/templates/ *.j2 *.ipynb

|

||||

include freqtrade/exchange/binance_leverage_tiers.json

|

||||

include freqtrade/rpc/api_server/ui/fallback_file.html

|

||||

include freqtrade/rpc/api_server/ui/favicon.ico

|

||||

|

||||

51

README.md

51

README.md

@@ -5,10 +5,14 @@

|

||||

[](https://www.freqtrade.io)

|

||||

[](https://codeclimate.com/github/freqtrade/freqtrade/maintainability)

|

||||

|

||||

Freqtrade is a free and open source crypto trading bot written in Python. It is designed to support all major exchanges and be controlled via Telegram. It contains backtesting, plotting and money management tools as well as strategy optimization by machine learning.

|

||||

Freqtrade is a free and open source crypto trading bot written in Python. It is designed to support all major exchanges and be controlled via Telegram or webUI. It contains backtesting, plotting and money management tools as well as strategy optimization by machine learning.

|

||||

|

||||

|

||||

|

||||

## Sponsored promotion

|

||||

|

||||

[](https://tokenbot.com/?utm_source=github&utm_medium=freqtrade&utm_campaign=algodevs)

|

||||

|

||||

## Disclaimer

|

||||

|

||||

This software is for educational purposes only. Do not risk money which

|

||||

@@ -26,11 +30,13 @@ hesitate to read the source code and understand the mechanism of this bot.

|

||||

|

||||

Please read the [exchange specific notes](docs/exchanges.md) to learn about eventual, special configurations needed for each exchange.

|

||||

|

||||

- [X] [Binance](https://www.binance.com/) ([*Note for binance users](docs/exchanges.md#binance-blacklist))

|

||||

- [X] [Binance](https://www.binance.com/)

|

||||

- [X] [Bittrex](https://bittrex.com/)

|

||||

- [X] [Kraken](https://kraken.com/)

|

||||

- [X] [FTX](https://ftx.com)

|

||||

- [X] [FTX](https://ftx.com/#a=2258149)

|

||||

- [X] [Gate.io](https://www.gate.io/ref/6266643)

|

||||

- [X] [Huobi](http://huobi.com/)

|

||||

- [X] [Kraken](https://kraken.com/)

|

||||

- [X] [OKX](https://okx.com/) (Former OKEX)

|

||||

- [ ] [potentially many others](https://github.com/ccxt/ccxt/). _(We cannot guarantee they will work)_

|

||||

|

||||

### Community tested

|

||||

@@ -44,34 +50,28 @@ Exchanges confirmed working by the community:

|

||||

|

||||

We invite you to read the bot documentation to ensure you understand how the bot is working.

|

||||

|

||||

Please find the complete documentation on our [website](https://www.freqtrade.io).

|

||||

Please find the complete documentation on the [freqtrade website](https://www.freqtrade.io).

|

||||

|

||||

## Features

|

||||

|

||||

- [x] **Based on Python 3.7+**: For botting on any operating system - Windows, macOS and Linux.

|

||||

- [x] **Based on Python 3.8+**: For botting on any operating system - Windows, macOS and Linux.

|

||||

- [x] **Persistence**: Persistence is achieved through sqlite.

|

||||

- [x] **Dry-run**: Run the bot without paying money.

|

||||

- [x] **Backtesting**: Run a simulation of your buy/sell strategy.

|

||||

- [x] **Strategy Optimization by machine learning**: Use machine learning to optimize your buy/sell strategy parameters with real exchange data.

|

||||

- [x] **Edge position sizing** Calculate your win rate, risk reward ratio, the best stoploss and adjust your position size before taking a position for each specific market. [Learn more](https://www.freqtrade.io/en/latest/edge/).

|

||||

- [x] **Edge position sizing** Calculate your win rate, risk reward ratio, the best stoploss and adjust your position size before taking a position for each specific market. [Learn more](https://www.freqtrade.io/en/stable/edge/).

|

||||

- [x] **Whitelist crypto-currencies**: Select which crypto-currency you want to trade or use dynamic whitelists.

|

||||

- [x] **Blacklist crypto-currencies**: Select which crypto-currency you want to avoid.

|

||||

- [x] **Builtin WebUI**: Builtin web UI to manage your bot.

|

||||

- [x] **Manageable via Telegram**: Manage the bot with Telegram.

|

||||

- [x] **Display profit/loss in fiat**: Display your profit/loss in 33 fiat.

|

||||

- [x] **Daily summary of profit/loss**: Provide a daily summary of your profit/loss.

|

||||

- [x] **Display profit/loss in fiat**: Display your profit/loss in fiat currency.

|

||||

- [x] **Performance status report**: Provide a performance status of your current trades.

|

||||

|

||||

## Quick start

|

||||

|

||||

Freqtrade provides a Linux/macOS script to install all dependencies and help you to configure the bot.

|

||||

Please refer to the [Docker Quickstart documentation](https://www.freqtrade.io/en/stable/docker_quickstart/) on how to get started quickly.

|

||||

|

||||

```bash

|

||||

git clone -b develop https://github.com/freqtrade/freqtrade.git

|

||||

cd freqtrade

|

||||

./setup.sh --install

|

||||

```

|

||||

|

||||

For any other type of installation please refer to [Installation doc](https://www.freqtrade.io/en/latest/installation/).

|

||||

For further (native) installation methods, please refer to the [Installation documentation page](https://www.freqtrade.io/en/stable/installation/).

|

||||

|

||||

## Basic Usage

|

||||

|

||||

@@ -121,14 +121,15 @@ optional arguments:

|

||||

|

||||

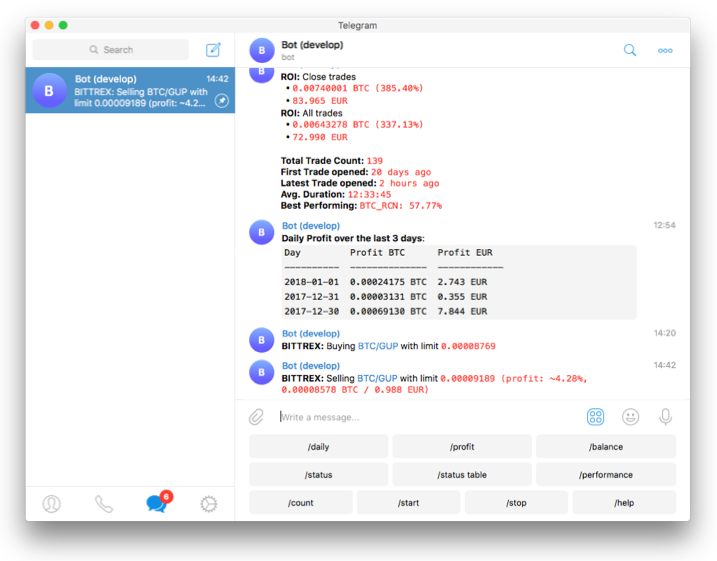

### Telegram RPC commands

|

||||

|

||||

Telegram is not mandatory. However, this is a great way to control your bot. More details and the full command list on our [documentation](https://www.freqtrade.io/en/latest/telegram-usage/)

|

||||

Telegram is not mandatory. However, this is a great way to control your bot. More details and the full command list on the [documentation](https://www.freqtrade.io/en/latest/telegram-usage/)

|

||||

|

||||

- `/start`: Starts the trader.

|

||||

- `/stop`: Stops the trader.

|

||||

- `/stopbuy`: Stop entering new trades.

|

||||

- `/status <trade_id>|[table]`: Lists all or specific open trades.

|

||||

- `/profit [<n>]`: Lists cumulative profit from all finished trades, over the last n days.

|

||||

- `/forcesell <trade_id>|all`: Instantly sells the given trade (Ignoring `minimum_roi`).

|

||||

- `/forceexit <trade_id>|all`: Instantly exits the given trade (Ignoring `minimum_roi`).

|

||||

- `/fx <trade_id>|all`: Alias to `/forceexit`

|

||||

- `/performance`: Show performance of each finished trade grouped by pair

|

||||

- `/balance`: Show account balance per currency.

|

||||

- `/daily <n>`: Shows profit or loss per day, over the last n days.

|

||||

@@ -152,10 +153,10 @@ For any questions not covered by the documentation or for further information ab

|

||||

### [Bugs / Issues](https://github.com/freqtrade/freqtrade/issues?q=is%3Aissue)

|

||||

|

||||

If you discover a bug in the bot, please

|

||||

[search our issue tracker](https://github.com/freqtrade/freqtrade/issues?q=is%3Aissue)

|

||||

[search the issue tracker](https://github.com/freqtrade/freqtrade/issues?q=is%3Aissue)

|

||||

first. If it hasn't been reported, please

|

||||

[create a new issue](https://github.com/freqtrade/freqtrade/issues/new/choose) and

|

||||

ensure you follow the template guide so that our team can assist you as

|

||||

ensure you follow the template guide so that the team can assist you as

|

||||

quickly as possible.

|

||||

|

||||

### [Feature Requests](https://github.com/freqtrade/freqtrade/labels/enhancement)

|

||||

@@ -169,13 +170,13 @@ in the bug reports.

|

||||

|

||||

### [Pull Requests](https://github.com/freqtrade/freqtrade/pulls)

|

||||

|

||||

Feel like our bot is missing a feature? We welcome your pull requests!

|

||||

Feel like the bot is missing a feature? We welcome your pull requests!

|

||||

|

||||

Please read our

|

||||

Please read the

|

||||

[Contributing document](https://github.com/freqtrade/freqtrade/blob/develop/CONTRIBUTING.md)

|

||||

to understand the requirements before sending your pull-requests.

|

||||

|

||||

Coding is not a necessity to contribute - maybe start with improving our documentation?

|

||||

Coding is not a necessity to contribute - maybe start with improving the documentation?

|

||||

Issues labeled [good first issue](https://github.com/freqtrade/freqtrade/labels/good%20first%20issue) can be good first contributions, and will help get you familiar with the codebase.

|

||||

|

||||

**Note** before starting any major new feature work, *please open an issue describing what you are planning to do* or talk to us on [discord](https://discord.gg/p7nuUNVfP7) (please use the #dev channel for this). This will ensure that interested parties can give valuable feedback on the feature, and let others know that you are working on it.

|

||||

@@ -196,7 +197,7 @@ To run this bot we recommend you a cloud instance with a minimum of:

|

||||

|

||||

### Software requirements

|

||||

|

||||

- [Python 3.7.x](http://docs.python-guide.org/en/latest/starting/installation/)

|

||||

- [Python >= 3.8](http://docs.python-guide.org/en/latest/starting/installation/)

|

||||

- [pip](https://pip.pypa.io/en/stable/installing/)

|

||||

- [git](https://git-scm.com/book/en/v2/Getting-Started-Installing-Git)

|

||||

- [TA-Lib](https://mrjbq7.github.io/ta-lib/install.html)

|

||||

|

||||

Binary file not shown.

Binary file not shown.

Binary file not shown.

BIN

build_helpers/TA_Lib-0.4.24-cp310-cp310-win_amd64.whl

Normal file

BIN

build_helpers/TA_Lib-0.4.24-cp310-cp310-win_amd64.whl

Normal file

Binary file not shown.

BIN

build_helpers/TA_Lib-0.4.24-cp38-cp38-win_amd64.whl

Normal file

BIN

build_helpers/TA_Lib-0.4.24-cp38-cp38-win_amd64.whl

Normal file

Binary file not shown.

BIN

build_helpers/TA_Lib-0.4.24-cp39-cp39-win_amd64.whl

Normal file

BIN

build_helpers/TA_Lib-0.4.24-cp39-cp39-win_amd64.whl

Normal file

Binary file not shown.

@@ -11,8 +11,13 @@ if [ ! -f "${INSTALL_LOC}/lib/libta_lib.a" ]; then

|

||||

&& curl 'http://git.savannah.gnu.org/gitweb/?p=config.git;a=blob_plain;f=config.guess;hb=HEAD' -o config.guess \

|

||||

&& curl 'http://git.savannah.gnu.org/gitweb/?p=config.git;a=blob_plain;f=config.sub;hb=HEAD' -o config.sub \

|

||||

&& ./configure --prefix=${INSTALL_LOC}/ \

|

||||

&& make -j$(nproc) \

|

||||

&& which sudo && sudo make install || make install

|

||||

&& make

|

||||

if [ $? -ne 0 ]; then

|

||||

echo "Failed building ta-lib."

|

||||

cd .. && rm -rf ./ta-lib/

|

||||

exit 1

|

||||

fi

|

||||

which sudo && sudo make install || make install

|

||||

if [ -x "$(command -v apt-get)" ]; then

|

||||

echo "Updating library path using ldconfig"

|

||||

sudo ldconfig

|

||||

|

||||

@@ -1,19 +1,18 @@

|

||||

# Downloads don't work automatically, since the URL is regenerated via javascript.

|

||||

# Downloaded from https://www.lfd.uci.edu/~gohlke/pythonlibs/#ta-lib

|

||||

|

||||

python -m pip install --upgrade pip

|

||||

python -m pip install --upgrade pip wheel

|

||||

|

||||

$pyv = python -c "import sys; print(f'{sys.version_info.major}.{sys.version_info.minor}')"

|

||||

|

||||

if ($pyv -eq '3.7') {

|

||||

pip install build_helpers\TA_Lib-0.4.21-cp37-cp37m-win_amd64.whl

|

||||

}

|

||||

if ($pyv -eq '3.8') {

|

||||

pip install build_helpers\TA_Lib-0.4.21-cp38-cp38-win_amd64.whl

|

||||

pip install build_helpers\TA_Lib-0.4.24-cp38-cp38-win_amd64.whl

|

||||

}

|

||||

if ($pyv -eq '3.9') {

|

||||

pip install build_helpers\TA_Lib-0.4.21-cp39-cp39-win_amd64.whl

|

||||

pip install build_helpers\TA_Lib-0.4.24-cp39-cp39-win_amd64.whl

|

||||

}

|

||||

if ($pyv -eq '3.10') {

|

||||

pip install build_helpers\TA_Lib-0.4.24-cp310-cp310-win_amd64.whl

|

||||

}

|

||||

|

||||

pip install -r requirements-dev.txt

|

||||

pip install -e .

|

||||

|

||||

@@ -42,7 +42,7 @@ docker build --cache-from freqtrade:${TAG_ARM} --build-arg sourceimage=${CACHE_I

|

||||

docker tag freqtrade:$TAG_PLOT_ARM ${CACHE_IMAGE}:$TAG_PLOT_ARM

|

||||

|

||||

# Run backtest

|

||||

docker run --rm -v $(pwd)/config_examples/config_bittrex.example.json:/freqtrade/config.json:ro -v $(pwd)/tests:/tests freqtrade:${TAG_ARM} backtesting --datadir /tests/testdata --strategy-path /tests/strategy/strats/ --strategy StrategyTestV2

|

||||

docker run --rm -v $(pwd)/config_examples/config_bittrex.example.json:/freqtrade/config.json:ro -v $(pwd)/tests:/tests freqtrade:${TAG_ARM} backtesting --datadir /tests/testdata --strategy-path /tests/strategy/strats/ --strategy StrategyTestV3

|

||||

|

||||

if [ $? -ne 0 ]; then

|

||||

echo "failed running backtest"

|

||||

|

||||

@@ -53,7 +53,7 @@ docker build --cache-from freqtrade:${TAG} --build-arg sourceimage=${CACHE_IMAGE

|

||||

docker tag freqtrade:$TAG_PLOT ${CACHE_IMAGE}:$TAG_PLOT

|

||||

|

||||

# Run backtest

|

||||

docker run --rm -v $(pwd)/config_examples/config_bittrex.example.json:/freqtrade/config.json:ro -v $(pwd)/tests:/tests freqtrade:${TAG} backtesting --datadir /tests/testdata --strategy-path /tests/strategy/strats/ --strategy StrategyTestV2

|

||||

docker run --rm -v $(pwd)/config_examples/config_bittrex.example.json:/freqtrade/config.json:ro -v $(pwd)/tests:/tests freqtrade:${TAG} backtesting --datadir /tests/testdata --strategy-path /tests/strategy/strats/ --strategy StrategyTestV3

|

||||

|

||||

if [ $? -ne 0 ]; then

|

||||

echo "failed running backtest"

|

||||

|

||||

@@ -8,19 +8,23 @@

|

||||

"dry_run": true,

|

||||

"cancel_open_orders_on_exit": false,

|

||||

"unfilledtimeout": {

|

||||

"buy": 10,

|

||||

"sell": 30

|

||||

"entry": 10,

|

||||

"exit": 10,

|

||||

"exit_timeout_count": 0,

|

||||

"unit": "minutes"

|

||||

},

|

||||

"bid_strategy": {

|

||||

"ask_last_balance": 0.0,

|

||||

"entry_pricing": {

|

||||

"price_side": "same",

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1,

|

||||

"price_last_balance": 0.0,

|

||||

"check_depth_of_market": {

|

||||

"enabled": false,

|

||||

"bids_to_ask_delta": 1

|

||||

}

|

||||

},

|

||||

"ask_strategy": {

|

||||

"exit_pricing": {

|

||||

"price_side": "same",

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1

|

||||

},

|

||||

@@ -28,10 +32,8 @@

|

||||

"name": "binance",

|

||||

"key": "your_exchange_key",

|

||||

"secret": "your_exchange_secret",

|

||||

"ccxt_config": {"enableRateLimit": true},

|

||||

"ccxt_config": {},

|

||||

"ccxt_async_config": {

|

||||

"enableRateLimit": true,

|

||||

"rateLimit": 200

|

||||

},

|

||||

"pair_whitelist": [

|

||||

"ALGO/BTC",

|

||||

@@ -88,7 +90,7 @@

|

||||

},

|

||||

"bot_name": "freqtrade",

|

||||

"initial_state": "running",

|

||||

"forcebuy_enable": false,

|

||||

"force_enter_enable": false,

|

||||

"internals": {

|

||||

"process_throttle_secs": 5

|

||||

}

|

||||

|

||||

@@ -8,19 +8,23 @@

|

||||

"dry_run": true,

|

||||

"cancel_open_orders_on_exit": false,

|

||||

"unfilledtimeout": {

|

||||

"buy": 10,

|

||||

"sell": 30

|

||||

"entry": 10,

|

||||

"exit": 10,

|

||||

"exit_timeout_count": 0,

|

||||

"unit": "minutes"

|

||||

},

|

||||

"bid_strategy": {

|

||||

"entry_pricing": {

|

||||

"price_side": "same",

|

||||

"use_order_book": true,

|

||||

"ask_last_balance": 0.0,

|

||||

"order_book_top": 1,

|

||||

"price_last_balance": 0.0,

|

||||

"check_depth_of_market": {

|

||||

"enabled": false,

|

||||

"bids_to_ask_delta": 1

|

||||

}

|

||||

},

|

||||

"ask_strategy":{

|

||||

"exit_pricing":{

|

||||

"price_side": "same",

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1

|

||||

},

|

||||

@@ -83,7 +87,7 @@

|

||||

},

|

||||

"bot_name": "freqtrade",

|

||||

"initial_state": "running",

|

||||

"forcebuy_enable": false,

|

||||

"force_entry_enable": false,

|

||||

"internals": {

|

||||

"process_throttle_secs": 5

|

||||

}

|

||||

|

||||

@@ -8,19 +8,23 @@

|

||||

"dry_run": true,

|

||||

"cancel_open_orders_on_exit": false,

|

||||

"unfilledtimeout": {

|

||||

"buy": 10,

|

||||

"sell": 30

|

||||

"entry": 10,

|

||||

"exit": 10,

|

||||

"exit_timeout_count": 0,

|

||||

"unit": "minutes"

|

||||

},

|

||||

"bid_strategy": {

|

||||

"ask_last_balance": 0.0,

|

||||

"entry_pricing": {

|

||||

"price_side": "same",

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1,

|

||||

"price_last_balance": 0.0,

|

||||

"check_depth_of_market": {

|

||||

"enabled": false,

|

||||

"bids_to_ask_delta": 1

|

||||

}

|

||||

},

|

||||

"ask_strategy": {

|

||||

"exit_pricing": {

|

||||

"price_side": "same",

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1

|

||||

},

|

||||

@@ -28,11 +32,8 @@

|

||||

"name": "ftx",

|

||||

"key": "your_exchange_key",

|

||||

"secret": "your_exchange_secret",

|

||||

"ccxt_config": {"enableRateLimit": true},

|

||||

"ccxt_async_config": {

|

||||

"enableRateLimit": true,

|

||||

"rateLimit": 50

|

||||

},

|

||||

"ccxt_config": {},

|

||||

"ccxt_async_config": {},

|

||||

"pair_whitelist": [

|

||||

"BTC/USD",

|

||||

"ETH/USD",

|

||||

@@ -88,7 +89,7 @@

|

||||

},

|

||||

"bot_name": "freqtrade",

|

||||

"initial_state": "running",

|

||||

"forcebuy_enable": false,

|

||||

"force_entry_enable": false,

|

||||

"internals": {

|

||||

"process_throttle_secs": 5

|

||||

}

|

||||

|

||||

@@ -8,16 +8,20 @@

|

||||

"amend_last_stake_amount": false,

|

||||

"last_stake_amount_min_ratio": 0.5,

|

||||

"dry_run": true,

|

||||

"dry_run_wallet": 1000,

|

||||

"cancel_open_orders_on_exit": false,

|

||||

"timeframe": "5m",

|

||||

"trailing_stop": false,

|

||||

"trailing_stop_positive": 0.005,

|

||||

"trailing_stop_positive_offset": 0.0051,

|

||||

"trailing_only_offset_is_reached": false,

|

||||

"use_sell_signal": true,

|

||||

"sell_profit_only": false,

|

||||

"sell_profit_offset": 0.0,

|

||||

"ignore_roi_if_buy_signal": false,

|

||||

"use_exit_signal": true,

|

||||

"exit_profit_only": false,

|

||||

"exit_profit_offset": 0.0,

|

||||

"ignore_roi_if_entry_signal": false,

|

||||

"ignore_buying_expired_candle_after": 300,

|

||||

"trading_mode": "spot",

|

||||

"margin_mode": "",

|

||||

"minimal_roi": {

|

||||

"40": 0.0,

|

||||

"30": 0.01,

|

||||

@@ -26,38 +30,41 @@

|

||||

},

|

||||

"stoploss": -0.10,

|

||||

"unfilledtimeout": {

|

||||

"buy": 10,

|

||||

"sell": 30,

|

||||

"entry": 10,

|

||||

"exit": 10,

|

||||

"exit_timeout_count": 0,

|

||||

"unit": "minutes"

|

||||

},

|

||||

"bid_strategy": {

|

||||

"price_side": "bid",

|

||||

"entry_pricing": {

|

||||

"price_side": "same",

|

||||

"use_order_book": true,

|

||||

"ask_last_balance": 0.0,

|

||||

"order_book_top": 1,

|

||||

"price_last_balance": 0.0,

|

||||

"check_depth_of_market": {

|

||||

"enabled": false,

|

||||

"bids_to_ask_delta": 1

|

||||

}

|

||||

},

|

||||

"ask_strategy":{

|

||||

"price_side": "ask",

|

||||

"exit_pricing":{

|

||||

"price_side": "same",

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1

|

||||

"order_book_top": 1,

|

||||

"price_last_balance": 0.0

|

||||

},

|

||||

"order_types": {

|

||||

"buy": "limit",

|

||||

"sell": "limit",

|

||||

"emergencysell": "market",

|

||||

"forcesell": "market",

|

||||

"forcebuy": "market",

|

||||

"entry": "limit",

|

||||

"exit": "limit",

|

||||

"emergency_exit": "market",

|

||||

"force_exit": "market",

|

||||

"force_entry": "market",

|

||||

"stoploss": "market",

|

||||

"stoploss_on_exchange": false,

|

||||

"stoploss_on_exchange_interval": 60

|

||||

"stoploss_on_exchange_interval": 60,

|

||||

"stoploss_on_exchange_limit_ratio": 0.99

|

||||

},

|

||||

"order_time_in_force": {

|

||||

"buy": "gtc",

|

||||

"sell": "gtc"

|

||||

"entry": "gtc",

|

||||

"exit": "gtc"

|

||||

},

|

||||

"pairlists": [

|

||||

{"method": "StaticPairList"},

|

||||

@@ -84,12 +91,9 @@

|

||||

"key": "your_exchange_key",

|

||||

"secret": "your_exchange_secret",

|

||||

"password": "",

|

||||

"ccxt_config": {"enableRateLimit": true},

|

||||

"ccxt_async_config": {

|

||||

"enableRateLimit": true,

|

||||

"rateLimit": 500,

|

||||

"aiohttp_trust_env": false

|

||||

},

|

||||

"log_responses": false,

|

||||

"ccxt_config": {},

|

||||

"ccxt_async_config": {},

|

||||

"pair_whitelist": [

|

||||

"ALGO/BTC",

|

||||

"ATOM/BTC",

|

||||

@@ -135,21 +139,21 @@

|

||||

"status": "on",

|

||||

"warning": "on",

|

||||

"startup": "on",

|

||||

"buy": "on",

|

||||

"buy_fill": "on",

|

||||

"sell": {

|

||||

"entry": "on",

|

||||

"entry_fill": "on",

|

||||

"exit": {

|

||||

"roi": "off",

|

||||

"emergency_sell": "off",

|

||||

"force_sell": "off",

|

||||

"sell_signal": "off",

|

||||

"emergency_exit": "off",

|

||||

"force_exit": "off",

|

||||

"exit_signal": "off",

|

||||

"trailing_stop_loss": "off",

|

||||

"stop_loss": "off",

|

||||

"stoploss_on_exchange": "off",

|

||||

"custom_sell": "off"

|

||||

"custom_exit": "off"

|

||||

},

|

||||

"sell_fill": "on",

|

||||

"buy_cancel": "on",

|

||||

"sell_cancel": "on",

|

||||

"exit_fill": "on",

|

||||

"entry_cancel": "on",

|

||||

"exit_cancel": "on",

|

||||

"protection_trigger": "off",

|

||||

"protection_trigger_global": "on"

|

||||

},

|

||||

@@ -170,7 +174,7 @@

|

||||

"bot_name": "freqtrade",

|

||||

"db_url": "sqlite:///tradesv3.sqlite",

|

||||

"initial_state": "running",

|

||||

"forcebuy_enable": false,

|

||||

"force_entry_enable": false,

|

||||

"internals": {

|

||||

"process_throttle_secs": 5,

|

||||

"heartbeat_interval": 60

|

||||

@@ -178,6 +182,7 @@

|

||||

"disable_dataframe_checks": false,

|

||||

"strategy": "SampleStrategy",

|

||||

"strategy_path": "user_data/strategies/",

|

||||

"add_config_files": [],

|

||||

"dataformat_ohlcv": "json",

|

||||

"dataformat_trades": "jsongz"

|

||||

}

|

||||

|

||||

@@ -8,19 +8,23 @@

|

||||

"dry_run": true,

|

||||

"cancel_open_orders_on_exit": false,

|

||||

"unfilledtimeout": {

|

||||

"buy": 10,

|

||||

"sell": 30

|

||||

"entry": 10,

|

||||

"exit": 10,

|

||||

"exit_timeout_count": 0,

|

||||

"unit": "minutes"

|

||||

},

|

||||

"bid_strategy": {

|

||||

"entry_pricing": {

|

||||

"price_side": "same",

|

||||

"use_order_book": true,

|

||||

"ask_last_balance": 0.0,

|

||||

"order_book_top": 1,

|

||||

"price_last_balance": 0.0,

|

||||

"check_depth_of_market": {

|

||||

"enabled": false,

|

||||

"bids_to_ask_delta": 1

|

||||

}

|

||||

},

|

||||

"ask_strategy":{

|

||||

"exit_pricing":{

|

||||

"price_side": "same",

|

||||

"use_order_book": true,

|

||||

"order_book_top": 1

|

||||

},

|

||||

@@ -28,10 +32,8 @@

|

||||

"name": "kraken",

|

||||

"key": "your_exchange_key",

|

||||

"secret": "your_exchange_key",

|

||||

"ccxt_config": {"enableRateLimit": true},

|

||||

"ccxt_config": {},

|

||||

"ccxt_async_config": {

|

||||

"enableRateLimit": true,

|

||||

"rateLimit": 1000

|

||||

},

|

||||

"pair_whitelist": [

|

||||

"ADA/EUR",

|

||||

@@ -93,7 +95,7 @@

|

||||

},

|

||||

"bot_name": "freqtrade",

|

||||

"initial_state": "running",

|

||||

"forcebuy_enable": false,

|

||||

"force_entry_enable": false,

|

||||

"internals": {

|

||||

"process_throttle_secs": 5

|

||||

},

|

||||

|

||||

@@ -15,10 +15,10 @@ services:

|

||||

volumes:

|

||||

- "./user_data:/freqtrade/user_data"

|

||||

# Expose api on port 8080 (localhost only)

|

||||

# Please read the https://www.freqtrade.io/en/latest/rest-api/ documentation

|

||||

# Please read the https://www.freqtrade.io/en/stable/rest-api/ documentation

|

||||

# before enabling this.

|

||||

# ports:

|

||||

# - "127.0.0.1:8080:8080"

|

||||

ports:

|

||||

- "127.0.0.1:8080:8080"

|

||||

# Default command used when running `docker compose up`

|

||||

command: >

|

||||

trade

|

||||

|

||||

@@ -1,4 +1,4 @@

|

||||

FROM python:3.7.10-slim-buster as base

|

||||

FROM python:3.9.9-slim-bullseye as base

|

||||

|

||||

# Setup env

|

||||

ENV LANG C.UTF-8

|

||||

|

||||

@@ -13,7 +13,7 @@ A sample of this can be found below, which is identical to the Default Hyperopt

|

||||

|

||||

``` python

|

||||

from datetime import datetime

|

||||

from typing import Dict

|

||||

from typing import Any, Dict

|

||||

|

||||

from pandas import DataFrame

|

||||

|

||||

@@ -56,7 +56,7 @@ Currently, the arguments are:

|

||||

|

||||

* `results`: DataFrame containing the resulting trades.

|

||||

The following columns are available in results (corresponds to the output-file of backtesting when used with `--export trades`):

|

||||

`pair, profit_ratio, profit_abs, open_date, open_rate, fee_open, close_date, close_rate, fee_close, amount, trade_duration, is_open, sell_reason, stake_amount, min_rate, max_rate, stop_loss_ratio, stop_loss_abs`

|

||||

`pair, profit_ratio, profit_abs, open_date, open_rate, fee_open, close_date, close_rate, fee_close, amount, trade_duration, is_open, exit_reason, stake_amount, min_rate, max_rate, stop_loss_ratio, stop_loss_abs`

|

||||

* `trade_count`: Amount of trades (identical to `len(results)`)

|

||||

* `min_date`: Start date of the timerange used

|

||||

* `min_date`: End date of the timerange used

|

||||

@@ -105,7 +105,7 @@ You can define your own estimator for Hyperopt by implementing `generate_estimat

|

||||

```python

|

||||

class MyAwesomeStrategy(IStrategy):

|

||||

class HyperOpt:

|

||||

def generate_estimator():

|

||||

def generate_estimator(dimensions: List['Dimension'], **kwargs):

|

||||

return "RF"

|

||||

|

||||

```

|

||||

@@ -119,13 +119,34 @@ Example for `ExtraTreesRegressor` ("ET") with additional parameters:

|

||||

```python

|

||||

class MyAwesomeStrategy(IStrategy):

|

||||

class HyperOpt:

|

||||

def generate_estimator():

|

||||

def generate_estimator(dimensions: List['Dimension'], **kwargs):

|

||||

from skopt.learning import ExtraTreesRegressor

|

||||

# Corresponds to "ET" - but allows additional parameters.

|

||||

return ExtraTreesRegressor(n_estimators=100)

|

||||

|

||||

```

|

||||

|

||||

The `dimensions` parameter is the list of `skopt.space.Dimension` objects corresponding to the parameters to be optimized. It can be used to create isotropic kernels for the `skopt.learning.GaussianProcessRegressor` estimator. Here's an example:

|

||||

|

||||

```python

|

||||

class MyAwesomeStrategy(IStrategy):

|

||||

class HyperOpt:

|

||||

def generate_estimator(dimensions: List['Dimension'], **kwargs):

|

||||

from skopt.utils import cook_estimator

|

||||

from skopt.learning.gaussian_process.kernels import (Matern, ConstantKernel)

|

||||

kernel_bounds = (0.0001, 10000)

|

||||

kernel = (

|

||||

ConstantKernel(1.0, kernel_bounds) *

|

||||

Matern(length_scale=np.ones(len(dimensions)), length_scale_bounds=[kernel_bounds for d in dimensions], nu=2.5)

|

||||

)

|

||||

kernel += (

|

||||

ConstantKernel(1.0, kernel_bounds) *

|

||||

Matern(length_scale=np.ones(len(dimensions)), length_scale_bounds=[kernel_bounds for d in dimensions], nu=1.5)

|

||||

)

|

||||

|

||||

return cook_estimator("GP", space=dimensions, kernel=kernel, n_restarts_optimizer=2)

|

||||

```

|

||||

|

||||

!!! Note

|

||||

While custom estimators can be provided, it's up to you as User to do research on possible parameters and analyze / understand which ones should be used.

|

||||

If you're unsure about this, best use one of the Defaults (`"ET"` has proven to be the most versatile) without further parameters.

|

||||

|

||||

@@ -52,6 +52,71 @@ freqtrade trade -c MyConfigUSDT.json -s MyCustomStrategy --db-url sqlite:///user

|

||||

|

||||

For more information regarding usage of the sqlite databases, for example to manually enter or remove trades, please refer to the [SQL Cheatsheet](sql_cheatsheet.md).

|

||||

|

||||

### Multiple instances using docker

|

||||

|

||||

To run multiple instances of freqtrade using docker you will need to edit the docker-compose.yml file and add all the instances you want as separate services. Remember, you can separate your configuration into multiple files, so it's a good idea to think about making them modular, then if you need to edit something common to all bots, you can do that in a single config file.

|

||||

``` yml

|

||||

---

|

||||

version: '3'

|

||||

services:

|

||||

freqtrade1:

|

||||

image: freqtradeorg/freqtrade:stable

|

||||

# image: freqtradeorg/freqtrade:develop

|

||||

# Use plotting image

|

||||

# image: freqtradeorg/freqtrade:develop_plot

|

||||

# Build step - only needed when additional dependencies are needed

|

||||

# build:

|

||||

# context: .

|

||||

# dockerfile: "./docker/Dockerfile.custom"

|

||||

restart: always

|

||||

container_name: freqtrade1

|

||||

volumes:

|

||||

- "./user_data:/freqtrade/user_data"

|

||||

# Expose api on port 8080 (localhost only)

|

||||

# Please read the https://www.freqtrade.io/en/latest/rest-api/ documentation

|

||||

# before enabling this.

|

||||

ports:

|

||||

- "127.0.0.1:8080:8080"

|

||||

# Default command used when running `docker compose up`

|

||||

command: >

|

||||

trade

|

||||

--logfile /freqtrade/user_data/logs/freqtrade1.log

|

||||

--db-url sqlite:////freqtrade/user_data/tradesv3_freqtrade1.sqlite

|

||||

--config /freqtrade/user_data/config.json

|

||||

--config /freqtrade/user_data/config.freqtrade1.json

|

||||

--strategy SampleStrategy

|

||||

|

||||

freqtrade2:

|

||||

image: freqtradeorg/freqtrade:stable

|

||||

# image: freqtradeorg/freqtrade:develop

|

||||

# Use plotting image

|

||||

# image: freqtradeorg/freqtrade:develop_plot

|

||||

# Build step - only needed when additional dependencies are needed

|

||||

# build:

|

||||

# context: .

|

||||

# dockerfile: "./docker/Dockerfile.custom"

|

||||

restart: always

|

||||

container_name: freqtrade2

|

||||

volumes:

|

||||

- "./user_data:/freqtrade/user_data"

|

||||

# Expose api on port 8080 (localhost only)

|

||||

# Please read the https://www.freqtrade.io/en/latest/rest-api/ documentation

|

||||

# before enabling this.

|

||||

ports:

|

||||

- "127.0.0.1:8081:8080"

|

||||

# Default command used when running `docker compose up`

|

||||

command: >

|

||||

trade

|

||||

--logfile /freqtrade/user_data/logs/freqtrade2.log

|

||||

--db-url sqlite:////freqtrade/user_data/tradesv3_freqtrade2.sqlite

|

||||

--config /freqtrade/user_data/config.json

|

||||

--config /freqtrade/user_data/config.freqtrade2.json

|

||||

--strategy SampleStrategy

|

||||

|

||||

```

|

||||

You can use whatever naming convention you want, freqtrade1 and 2 are arbitrary. Note, that you will need to use different database files, port mappings and telegram configurations for each instance, as mentioned above.

|

||||

|

||||

|

||||

## Configure the bot running as a systemd service

|

||||

|

||||

Copy the `freqtrade.service` file to your systemd user directory (usually `~/.config/systemd/user`) and update `WorkingDirectory` and `ExecStart` to match your setup.

|

||||

@@ -111,12 +176,15 @@ Log messages are send to `syslog` with the `user` facility. So you can see them

|

||||

On many systems `syslog` (`rsyslog`) fetches data from `journald` (and vice versa), so both `--logfile syslog` or `--logfile journald` can be used and the messages be viewed with both `journalctl` and a syslog viewer utility. You can combine this in any way which suites you better.

|

||||

|

||||

For `rsyslog` the messages from the bot can be redirected into a separate dedicated log file. To achieve this, add

|

||||

|

||||

```

|

||||

if $programname startswith "freqtrade" then -/var/log/freqtrade.log

|

||||

```

|

||||

|

||||

to one of the rsyslog configuration files, for example at the end of the `/etc/rsyslog.d/50-default.conf`.

|

||||

|

||||

For `syslog` (`rsyslog`), the reduction mode can be switched on. This will reduce the number of repeating messages. For instance, multiple bot Heartbeat messages will be reduced to a single message when nothing else happens with the bot. To achieve this, set in `/etc/rsyslog.conf`:

|

||||

|

||||

```

|

||||

# Filter duplicated messages

|

||||

$RepeatedMsgReduction on

|

||||

|

||||

BIN

docs/assets/TokenBot-Freqtrade-banner.png

Normal file

BIN

docs/assets/TokenBot-Freqtrade-banner.png

Normal file

Binary file not shown.

|

After Width: | Height: | Size: 60 KiB |

BIN

docs/assets/frequi_url.png

Normal file

BIN

docs/assets/frequi_url.png

Normal file

Binary file not shown.

|

After Width: | Height: | Size: 11 KiB |

Binary file not shown.

|

Before Width: | Height: | Size: 121 KiB After Width: | Height: | Size: 143 KiB |

BIN

docs/assets/windows_install.png

Normal file

BIN

docs/assets/windows_install.png

Normal file

Binary file not shown.

|

After Width: | Height: | Size: 92 KiB |

@@ -21,16 +21,18 @@ usage: freqtrade backtesting [-h] [-v] [--logfile FILE] [-V] [-c PATH]

|

||||

[--timeframe-detail TIMEFRAME_DETAIL]

|

||||

[--strategy-list STRATEGY_LIST [STRATEGY_LIST ...]]

|

||||

[--export {none,trades}] [--export-filename PATH]

|

||||

[--breakdown {day,week,month} [{day,week,month} ...]]

|

||||

[--cache {none,day,week,month}]

|

||||

|

||||

optional arguments:

|

||||

-h, --help show this help message and exit

|

||||

-i TIMEFRAME, --timeframe TIMEFRAME, --ticker-interval TIMEFRAME

|

||||

-i TIMEFRAME, --timeframe TIMEFRAME

|

||||

Specify timeframe (`1m`, `5m`, `30m`, `1h`, `1d`).

|

||||

--timerange TIMERANGE

|

||||

Specify what timerange of data to use.

|

||||

--data-format-ohlcv {json,jsongz,hdf5}

|

||||

Storage format for downloaded candle (OHLCV) data.

|

||||

(default: `None`).

|

||||

(default: `json`).

|

||||

--max-open-trades INT

|

||||

Override the value of the `max_open_trades`

|

||||

configuration setting.

|

||||

@@ -61,12 +63,11 @@ optional arguments:

|

||||

`30m`, `1h`, `1d`).

|

||||

--strategy-list STRATEGY_LIST [STRATEGY_LIST ...]

|

||||

Provide a space-separated list of strategies to

|

||||

backtest. Please note that ticker-interval needs to be

|

||||

backtest. Please note that timeframe needs to be

|

||||

set either in config or via command line. When using

|

||||

this together with `--export trades`, the strategy-

|

||||

name is injected into the filename (so `backtest-

|

||||

data.json` becomes `backtest-data-

|

||||

SampleStrategy.json`

|

||||

data.json` becomes `backtest-data-SampleStrategy.json`

|

||||

--export {none,trades}

|

||||

Export backtest results (default: trades).

|

||||

--export-filename PATH

|

||||

@@ -74,6 +75,11 @@ optional arguments:

|

||||

Requires `--export` to be set as well. Example:

|

||||

`--export-filename=user_data/backtest_results/backtest

|

||||

_today.json`

|

||||

--breakdown {day,week,month} [{day,week,month} ...]

|

||||

Show backtesting breakdown per [day, week, month].

|

||||

--cache {none,day,week,month}

|

||||

Load a cached backtest result no older than specified

|

||||

age (default: day).

|

||||

|

||||

Common arguments:

|

||||

-v, --verbose Verbose mode (-vv for more, -vvv to get all messages).

|

||||

@@ -113,7 +119,7 @@ The result of backtesting will confirm if your bot has better odds of making a p

|

||||

All profit calculations include fees, and freqtrade will use the exchange's default fees for the calculation.

|

||||

|

||||

!!! Warning "Using dynamic pairlists for backtesting"

|

||||

Using dynamic pairlists is possible, however it relies on the current market conditions - which will not reflect the historic status of the pairlist.

|

||||

Using dynamic pairlists is possible (not all of the handlers are allowed to be used in backtest mode), however it relies on the current market conditions - which will not reflect the historic status of the pairlist.

|

||||

Also, when using pairlists other than StaticPairlist, reproducibility of backtesting-results cannot be guaranteed.

|

||||

Please read the [pairlists documentation](plugins.md#pairlists) for more information.

|

||||

|

||||

@@ -268,55 +274,56 @@ A backtesting result will look like that:

|

||||

| XRP/BTC | 35 | 0.66 | 22.96 | 0.00114897 | 11.48 | 3:49:00 | 12 0 23 34.3 |

|

||||

| ZEC/BTC | 22 | -0.46 | -10.18 | -0.00050971 | -5.09 | 2:22:00 | 7 0 15 31.8 |

|

||||

| TOTAL | 429 | 0.36 | 152.41 | 0.00762792 | 76.20 | 4:12:00 | 186 0 243 43.4 |

|

||||

========================================================= SELL REASON STATS ==========================================================

|

||||

| Sell Reason | Sells | Wins | Draws | Losses |

|

||||

========================================================= EXIT REASON STATS ==========================================================

|

||||

| Exit Reason | Sells | Wins | Draws | Losses |

|

||||

|:-------------------|--------:|------:|-------:|--------:|

|

||||

| trailing_stop_loss | 205 | 150 | 0 | 55 |

|

||||

| stop_loss | 166 | 0 | 0 | 166 |

|

||||

| sell_signal | 56 | 36 | 0 | 20 |

|

||||

| force_sell | 2 | 0 | 0 | 2 |

|

||||

| exit_signal | 56 | 36 | 0 | 20 |

|

||||

| force_exit | 2 | 0 | 0 | 2 |

|

||||

====================================================== LEFT OPEN TRADES REPORT ======================================================

|

||||

| Pair | Buys | Avg Profit % | Cum Profit % | Tot Profit BTC | Tot Profit % | Avg Duration | Win Draw Loss Win% |

|

||||

|:---------|-------:|---------------:|---------------:|-----------------:|---------------:|:---------------|--------------------:|

|

||||

| ADA/BTC | 1 | 0.89 | 0.89 | 0.00004434 | 0.44 | 6:00:00 | 1 0 0 100 |

|